How the AMT might doom Bush's tax cuts

A House Ways and Means subcommittee held hearings on the fixing the alternative minimum tax this afternoon. My colleague Jeanne Sahadi wrote a clear and concise guide to the options lawmakers have in dealing with the AMT mess, which you can read here.

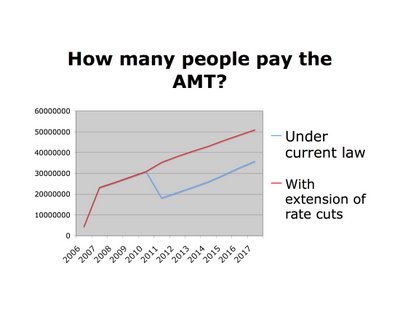

Check out this chart, which is based on data from the Joint Committee on Taxation. The blue line is how many people will be snagged by the AMT under current law. The red line is how many people will have to pay it if the 2001 rate reductions are renewed. (They are set to "sunset" in 2011.) Extending the tax cuts will dramatically increase the number of people who will have to deal with two separate tax systems, even as fewer and fewer people enjoy the benefits of the cuts. That's because without those tax cuts, more people would have a high enough tax under the regular system that they wouldn't be moved into the AMT.  One thing to be clear about: This chart does not mean that the Bush tax cuts will actually raise the taxes of those who end up on the AMT. As Alan Viard of the American Enterprise Institute explains in his Ways and Means testimony today: One thing to be clear about: This chart does not mean that the Bush tax cuts will actually raise the taxes of those who end up on the AMT. As Alan Viard of the American Enterprise Institute explains in his Ways and Means testimony today:Suppose that, without [the recent tax laws], a hypothetical taxpayer would have a $100 tax liability under regular tax rules and a $90 tax liability under AMT rules. The taxpayer would then be on the regular income tax and would have a $100 tax liability. Suppose that those laws reduce the taxpayer’s liability under regular tax rules to $85 while leaving his or her liability under AMT rules unchanged at $90. Because liability under the AMT rules is now higher than the liability under the regular tax rules, the taxpayer moves onto the AMT and has a $90 tax liability.Even so, the AMT clearly erodes the constituency for extending the tax cuts. Not to mention driving people crazy. Update 3/8: Want to pin the AMT mess on the Republicans? Or maybe on the Democrats? Check out my post, "Alternative minimum blame." Because I live in a high property tax area and have 5 children I get killed with the amt.

One more thing, the amt doesn't allow

my 7 exemptions which is woth about 24,000 so 26% of that is about $6,000 which could be put towards their education. I just got married this year and it looks like together we will make just over 100k. Is there any chance of an 11th hour fix to raise the phase in of the AMT for this 2006 filing year?

What was congress thinking by not indexing the AMT? I live in a very expensive part of the country with high taxes already and I have to get hit with yet another tax too! Why is this not causing riots in the street yet? Are we back to Reagan's trickle down economics...

Valerie UsVisionaries.com While the American Express person's testimony is factual, it ignores the critical component of tax policy: fairness.

I am in the same boat as Allison. My marginal tax rate under AMT is 35% due to phase out of exemptions. A VERY wealthy, VERY high income individual with largely income from dividends and capital gains will still pay at a marginal rate of 15%. Even if the very high income is wage based, it will be taxed at a maximum marginal rate of 28%. So...the Bush tax cuts did provide much higher benefits to the very high paid, and further favor investment income over earned income. Remind me why I voted for this guy? I'm hearing that some economists are reccomending ending the AMT and raising tax rates for everyone to keep it revenue neutral. That means to me, a single, childless person making $50,000 per year, would get to pay higher taxes in order to let families with large amounts of chidren keep their overly generous tax cuts. The fact is that families with several children pay very little in taxes comared to singles. The AMT simply washes out some of the tax cuts. I say, keep the AMT or get rid of all the tax breaks families with kids get. I should not have to subsidize families.

It is true that dividends are taxed at the 15 percent capital gains rate, but that is after they have already been taxed as corporate income, so that income is being taxed twice. The tax cuts didn't provide any "benefits" to anyone. It just let them keep their own money.

The Bush tax cuts are a fraud. I never saved a penny in taxes because I've been paying AMT for years. Millionaires who make all their income from capital gains don't have to pay it, but the working class does. It's a transfer of taxes from the rich to the middle class.

The serious issues facing this country will not be resolved until the people who vote realize that they are the problem and not the solution. A consumption tax system needs to be implemented.

The AMT is completely unjust and its continued presence in our country's tax code seriously calls into question the competency of our Congressional leaders. Its primary failure is its inability to account for substantial differences in the cost of living across this country. For example, I live in a two bedroom "apartment" in New York, have over $100,000 in student loans, a negative net worth, and a child and a wife to support, but because I make $200,000 in compensation (which is not much in New York) the AMT strips me of most deductions. My tax bill is ridiculous and completely hinders my ability to make much financial progress.

Other aspects of our federal tax code that disallow for certain deductions when certain income thresholds have been surpassed (e.g., dependents, student loan interest, etc.) are also unfair, but the AMT is by far the most egregious. Frank, why would earned income be taxed at only 28% for high income households???

And income from dividends or capital gains has essentially been taxed twice: once when it was earned, and subsequently invested, and again when gains are realized or dividends paid. And all of you who voted for him twice did so WHY?? Any middle class citizen like myself has suffered through this administration, and as Shawn has stated, "Why isn't this causing riots in the streets?" Because the simple mention of 'tax cuts' had everyone flocking to the polls like shhe to the slaughter.

This is one of the biggest frauds in the tax code, gets so much press, and nothing gets done. The middle class continues to get squeezed, while the rich have their tax burdens reduced. It's part and parcel of the Bush presidency, smoke and mirrors. Widen the gap between rich and the rest. We have only to look at third world countries, and our own late 19th century history, to see what happens when an elite class of people continue to get extraordinarily rich at everyone else's expense. It is most preposterous when this is done thru the tax code. Come on Congress, WAKE UP AND VOID THIS TAX...

The fiscal reality in this country is that the bulk of tax revenue comes not from the uber-rich or the working poor,it comes from the enormous numbers of upper middle class, wage earning , professional families primarily located in high population, high tax states on both coasts. The only equitable way of reforming the tax system is to have a value-added type consumption tax with an exemption for lower incomes so as not to make it a regressive burden. It can be overall revenue neutral and perhaps even have the added benefit of increasing personal savings and investment.

It's clear why Bush loves the AMT. It increases taxes for the middle class but has been designed to avoid taxing the rich. Remember, the rich mostly make capital gains and dividends, and THE AMT DOES NOT APPLY TO THAT. So the Bush tax plan is:

Rich: 15% tax rate + small amount state and local Middle class: 28% AMT tax rate, + 15.3% total net social security tax (much of which is used for general expenditures) + a higher state and local rate piggybacked on the higher federal rate. If you are worth less than 5 million dollars and you voted for Bush, you are a chump. The last line of my previous post should have read "Because the simple mention of 'tax cuts' had everyone flocking to the polls like sheep to the slaughter." And, on top of all this. gas is headed towards $3 a gallon, plus all of us in Southern Illinois are getting hosed by Ameren for an electric rate increase that has doubled most of our utility bills... This 'deregulation' wet dream of Reagan's that was supposed to have led to 'competition' has only led to companies buying one another, thus eliminating competition, making share holders more wealthy and creating monopolies.

The AMT allows Bush to claim that he cut taxes without actually having done so. My taxes have gone up since Mr Bush took office, not down.

We should also be honest with ourselves. This country cannot afford tax cuts. No sane president has ever cut taxes and gone to war, only our Texas village idiot has. We too have five children, from 14 through 22. I work a full time and part time job and my wife works 30-35 hours a week. Our college age children work part time as well. The income is needed to pay for education, but also pushes us into the AMT. This creates the absurd situation where we need to earn more to overcome the additional AMT tax burden. Of course, by earning more, we are taxed more.

Excuse me but I'm thinking that BUSH doesn't write the tax code. Blame everything on Bush. It's the system Stupid. A National Sales tax is the solution. Everyone pays by consuming goods and services. Rich consume more that poor so they pay more tax. DUH

This is the United States of America, where Capitalism reigns supreme, not some socialistic state. The fact that our tax code favors Investment income over Earned income should suprise no one. Save and purchase real assets (things that produce income), and one will reap the benefits so rightly afforded us by our great, Capitalistic country!

The changes proposed to the AMT are simply part of the new economic caste system in the USA. Unlike previous class systems in this country, this one is based on the notion that income transfers are somehow evil, and that it will be up to the individual income classes to fund benefits within the income class, or members of each income class can "opt out" and pay for their own benefits. Meaning that the poor will be taxed to pay for their education, health and welfare benefits; the middle gets taxed for their portion, etc.. The very rich can, if they want to, opt out of the system and pay for their own education, health and other benefits. If you want examples take a close look at the Bush Social Security proposal, Roth conversion changes in last year's Pension Act, and the latest proposal on health insurance. Each of these plans allow the rich to opt out. And, of course, it is very easy for them to do so, (they're rich) but since the rationale of the Bush Administration is that if the rich get no benefit they shouldn't have to pay anything for anyone else's benefits the income transfers built into the tax code since WWII are simply vanishing. But, paradoxically, the burden for national defense should be imposed on all citizens...but don't the rich have much more to protect?

I'm a CPA, and to put the future effects of the AMT in perspective, here's a nice little stat:

If the AMT is not adjusted, 60% of families who own a house and have 2 children will pay AMT by 2010. For those who wonder why AMT has never been adjusted, the answer is simple. Politicians, both Republican and Democrat, are addicted to the money it generates. The 10-year cost to eliminate the AMT, if enacted today, would be over $2 trillion dollars. The only way to bridge that gap is to raise taxes or cut spending, neither of which is all that popular with voters. So, AMT stays in place, unindexed. Fixing AMT is a lot like fixing Social Security. Everyone knows there is a very expensive problem looming, but the solutions are hard and unpopular. In the end, nothing gets done except some hearings that will make for good press but little substance. The Democrats control and House and the Senate. What is all this anti Bush BS. If the AMT is not removed, look to the people that run Congress. My eight year old undertands the functions of government better then half the people who posted to this article. By the way, my tax refund has increased by $5,000 since the child tax credits were pushed by President Bush. The middle class with children makes out much better under republican control. Clinton tries so hard for a middle class tax decrease but just could not do it. YA he tried real hard.

Elias, I agree we must void the AMT. However, I fear the rantings of certain political candidates and members of Congress are perpetuating the myth that the gap is growing between the rich and the rest and that the Bush tax cuts further widen this gap. The Feb. 6 Wall Street Journal article by Reynolds and Henderson debunks this myth and sources (eg. CBO data)used to perpetuate it. Quoting a study done by the IRS Statistics of Income Division as well as one done by a Federal Reserve Board economist, the authors show that that percentage of income held by the top 1% remained the same or declined slightly from 1995 to the early 2000's. To equate our country with its opportunities to move between classes to circumstances in third world countries is misguided, at best.

This is for Terry in Illinois,

Hopefully you are thankful that when you are 70 collecting Social Security that souls like myself sacrificed and had children (who end up working and paying taxes) to support you in your old age. What goes around comes around. By my supporting/raising 3 children and sending them to college to get good jobs in order to pay taxes, I am actually supporting you. Why aren't the recommendations of Bush's own 2005 tax reform commission being used as the basis of AMT reform?

It recommended several much needed "fixes" to the U.S. taxation system, including simplification, elimination of the marriage penalty and AMT. Yes, the cost of paying for it was the elimination of some sacred cows: deductions for state/local taxes, restrictions on mortgage interest deductions, etc. However, the overall payoff would have been a much simpler, more efficient system than anything the Republicans or Democrats have yet proposed. It should be mandatory reading for every Congressperson. I enjoy the guys comments who has his head stuck in the black and white cloud,� Save and purchase real assets"

Well genius capitalism doesn�t work that way, in order for capitalism to work their must be a larger amount of people paying money for you assets or working at low wages so your asset remains an asset. DUH !Reciprocity is not in the capitalist vocabulary. Capitalism is a game of musical chairs and we all know how it�s played and there�s only one winner, but the game needs all the other losers in order to be played. Capitalism requires exploitation of something in order to work, third world countries, nature, workers, and taxes are all exploited for the benefit of the few. Lets not try to deny this basic need of capitalism. To Elain in Stafford, VA:

The current tax system absolutely pillages the earnings of young upper-middle class couples without children in three ways. 1. The mortgage interest tax deduction has contributed to the gross inflation of residential realestate values, making it almost impossible for first-time homebuyers w/o family contribution to purchase without exorbanent amounts of debt. 2. Many deductions, such as student loan interest, quickly disappear as your income rises. 3. The marriage penalty quickly kicks in with two professional incomes. Consequently, my wife and I cannot afford to have children. We have two mortgages and student loans to pay. The marriage penalty is actually hitting us so bad we've talked about getting divorced in order to reduce our tax burden, sucking away money that could be used to reduce debt. The money being consumed to give your tax benefits and inflated home value is preventing the next generation of professionals from being born. For Michael in Seattle:

You are correct: "Reciprocity" is not in a Capitalist's vocabulary, and thus it cannot be a game of musical chairs as you suggested it to be. Capitalism is about the creation of assets vice simply moving assets around like musical chairs as you suggest, such as a business, that can obtain other assets and investments, and so on. Yes, it is the Capitalists that create the jobs most people clutch to. Which would you rather be, an owner or an employee? I choose "owner." p.s. Thank you for suggesting that I am a genius. However, I am merely financially literate, and choose to apply (and share) what I have learned. To Erik in Baltimore. You don't have to feel special that you are being selectively pillaged as a young professional couple to be pillaged by the AMT. My Husband and I are an "old" professional couple and we are being pillaged by the AMT while trying to support our 2 children and send one of them to college. Even though we are supporting the next generation of replacement tax payers we get no tax benefits for doing so. Values that the AMT encourages are that it is more important to have a big mortgage (the interest of which is deductible under AMT) rather than the cost of nurturing children which is not allowed under AMT. This is banal.

My capital gains are taxed at 22% rather than 15% because above a certain level, for every $4 in income (whether from wages or capital gains) you lose a $1 in you AMT deduction. This results in a another 7% tax on capital gains. Ever since the Bush tax "cuts" I have had to have substantially more money manually taken out of my check for federal taxes, because withholding as my company figures it without the AMT is pathetic. The only reason that the Bush tax "cuts" have not resulted in a huge increase in the federal deficit is because a lot of the taxes are made up by people paying the AMT. The tax cuts are nothing but smoke and mirrors. The AMT is unfair and makes is hard to calculate your tax liabilies throughout the year. it would be fairer to either eliminate the AMT and end the Bush tax cuts, or go to a flat tax (just like the AMT), and make EVERYONE pay it. I have suggested the same thing to my husband as another person mentioned: for tax purposes it would be much cheaper to get quietly divorced and just continue to live together. Maybe get remarried if AMT is ever ended before one of us dies. The Husband being a Catholic didn't go for it. While many posters complain about the inherent unfairness of the AMT and the way it affects folks living in high tax states, I am unaware of any laws resricting the freedom of movement in the US.

If the income tax laws of your state are so terrible, and they also force you into paying the AMT, why not move to a lower tax state? States like Washington and Texas have no income tax, and their residents are much less likely to be hit by the AMT. I can speak from personal experience that some years my wife and I do make over $175,000 a year, and we have no children, but we have never been subject to the AMT. And we sure as heck have never paid state income tax. I often think of the US as being made up of 50 separate countries. If you really don't like the one you live in, vote with your feet. "If the income tax laws of your state are so terrible, and they also force you into paying the AMT, why not move to a lower tax state? States like Washington and Texas have no income tax, and their residents are much less likely to be hit by the AMT."

It's not so easy to move and find another job that pays as much as the one you have now. Some of us still have pensions that might be imperiled by a new job. Those of us with children to support often have difficulty moving away from the support systems that allow us to cope with with raising our children and having a full time job. Lastly not all of us have jobs that even exist in some of the low tax states. There are not a lot of excess jobs floating around to jsut grap. One often has to find a job and move where that job happens to be. To Erik, if your wife had a child and left the workforce your income would fall and you would gain deductions and you would not have AMT. I think that is a better solution than divorcing. Or move to a lower tax state or buy a house with cheaper property taxes or pay off your student loans. Saying you earn to much to afford kids is pretty funny.

"To Erik, if your wife had a child and left the workforce your income would fall and you would gain deductions and you would not have AMT. I think that is a better solution than divorcing. Or move to a lower tax state or buy a house with cheaper property taxes or pay off your student loans. Saying you earn to much to afford kids is pretty funny."

It's not funny. I am myself familar with Eric's situation. They would still have more money left after taxes if they merely divorce, live together and have a child. You don't have to advertize that you are getting divorced. You just need a certificate to show the IRS. This is the part that is banal. The AMT discourages marriage, and the nurturing of children by it's structure. By gaining another dependant, the AMT might kick in anyway. The deductions for you mortgage insurance are allowed on AMT no matter what your income is which your children are not. Maybe it would be "safer" to jsut buy a bigger house with a bigger mortage. My husband and I have calculated our taxes as if each of us were single using Turbotax. The AMT in that case didn't kick in, and we both owed a lot less money in taxes. Eric can just tell his wife that she should quit working so that they can have a child. That might merely imperil his wifes's future ability to earn a living in order to save on taxes in the short term. That is not smart for the long haul for her. When Bush pushed the tax cuts for the rich (Cap gains, dividends, etc.), he was quite honest that he "would make up the revenue" with the AMT. The AMT falls on middle income taxpayers in blue states with high property and state income taxes. So while the Dick Cheney and Scooter Libby types get a tax windfall, we get screwed. Look at who the Bush tax cuts have benefitted. The "trickle down" approach was discredited decades ago. Hopefully, the Democrats will take some action to assist the middle class.

The AMT is truly a bipartisan achievement in revenue collection. Anyone expecting anything but a temporary patch is delusional.

taxes must be paid. By everyone

10% income tax (first $20'000 exempt) 10% capital gains 10% sales tax (food and medical exempt) nice and simple any hope? This is not my idea of AMT reform.

//money.cnn.com/2007/03/14/pf/taxes/amt_capgains/index.htm?postversion=2007031414 First of all because of the loss of the AMT exemption many people like myself are already paying 22% effective tax on capital gains. These proposals preserve the appearance of the Bush tax cuts while making the AMT even more complicated to figure. If you owe AMT you ought at least not to have to pay a penalty for underpaid taxes because it is very hard to figure out how much you have to pay with all these complicated rules and it looks like if Congress passes one of these proposals, it is going to get worst. Consider the married person who has been frugal all their life, and has perhaps $400K in CDs and IRAs. The spouse dies. The person reaches 70+ and is required to take distribution from the IRAs. AMT kicks in (on top of the Medicare $3K doughnut hole) and s/he drops to the bottom of the middle class in terms of assets. Thanks a lot.

AMT has a hidden cost - tax preparation fees. I paid over $600 for tax preparation this year, whereas I used to be able to prepare my own taxes until I hit the AMT.

CNNMoney.com Comment Policy: CNNMoney.com encourages you to add a comment to this discussion. You may not post any unlawful, threatening, libelous, defamatory, obscene, pornographic or other material that would violate the law. Please note that CNNMoney.com makes reasonable efforts to review all comments prior to posting and CNNMoney.com may edit comments for clarity or to keep out questionable or off-topic material. All comments should be relevant to the post and remain respectful of other authors and commenters. By submitting your comment, you hereby give CNNMoney.com the right, but not the obligation, to post, air, edit, exhibit, telecast, cablecast, webcast, re-use, publish, reproduce, use, license, print, distribute or otherwise use your comment(s) and accompanying personal identifying information via all forms of media now known or hereafter devised, worldwide, in perpetuity. CNNMoney.com Privacy Statement.

|

|