Retire without taxes

Only one savings plan gives you the chance to free yourself from taxes in retirement. Are you making the most of it?

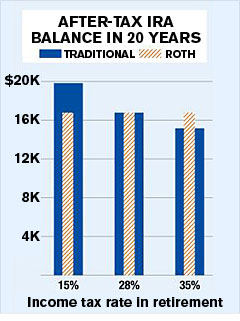

Roth vs. regular IRA? The math changes if your tax rate moves. See what happens to $5,000 if you're in the 28% bracket today.

Typically, you're in the lowest bracket you'll ever see when you're young and your income is modest, making the Roth a better bet. Even if you're in mid-career or later, don't assume you'll drop into a lower tax bracket. In retirement, much of your income will consist of 401(k) and IRA withdrawals and, possibly, a pension. But since you're no longer reducing your taxable income by contributing to 401(k)s and IRAs, you could end up in the same tax bracket, if not a higher one.

This uncertainty provides yet another reason to put at least some money in a Roth. The concept is simple: Just as it pays to spread your retirement savings among different types of stocks and bonds, it makes sense to diversify your tax exposure. You'll pay ordinary income tax on withdrawals from regular 401(k)s and IRAs. If your entire portfolio is in such accounts, you could lose as much as 35% to taxes. If Congress raises tax rates, your spendable income will shrink even more.

Funding a Roth allows you to hedge that risk. It also gives you more flexibility to manage your tax bill. If a larger-than-usual one-time withdrawal from your 401(k) will push you into a higher tax bracket, you can avoid the bigger tax hit by pulling tax-free money from your Roth instead.

NEXT: Will Congress take away the tax benefits?

Last updated September 16 2008: 11:34 AM ET

Source: Money research.

Note: Roth investment is after-tax, or $3,600.

Note: Roth investment is after-tax, or $3,600.