Retire without taxes

Only one savings plan gives you the chance to free yourself from taxes in retirement. Are you making the most of it?

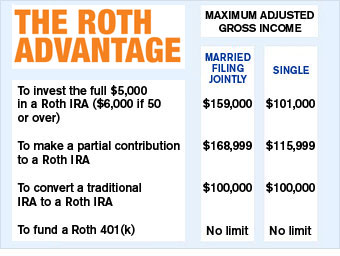

The contribution limits for Roth 401(k)s are the same as for regular 401(k)s: $15,500 this year, plus $5,000 in catch-up contributions if you are 50 or older. As for the Roth IRA, eligibility comes down solely to how much you make, as you can see in the table at right.

By the way, there's nothing to prevent you from splitting your 401(k) funds between a regular and a Roth 401(k), although if you decide to do that, remember that any matching funds your employer kicks in will go to a regular 401(k). Similarly, assuming you qualify for both types of accounts, you can also divvy up your IRA contribution between a traditional IRA and a Roth.

NEXT: Can I move my old IRAs into a Roth?

Last updated September 16 2008: 11:34 AM ET

Note: Figures for 2008.