Retire without taxes

Only one savings plan gives you the chance to free yourself from taxes in retirement. Are you making the most of it?

You also need to think about what converting will do to your overall income tax bill. Even though the amount you convert doesn't affect your eligibility (if your AGI is $97,000 and you convert a $20,000 IRA, that doesn't push you over the $100,000 cap), it's considered taxable income. So a large 401(k) or IRA could nudge you into a higher bracket. In that case, convert smaller amounts over a few years or wait until you're in a lower bracket.

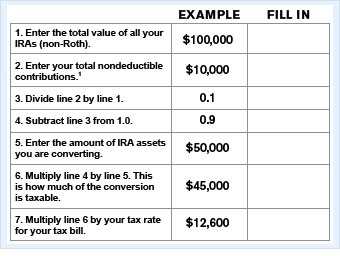

Finally, if you've ever opened a nondeductible IRA - or rolled a 401(k) with after-tax contributions into an IRA - you might think you could avoid taxes by converting only those after-tax dollars. Nice try, but you can't cherrypick funds. When you move just a piece of your IRA money into a Roth, for tax purposes the amount you convert is considered to have the same blend of pretax and after-tax dollars as all of your non-Roth IRAs. That could leave you with a complicated tax bill if you are converting just a portion of your IRA funds. You can use the worksheet to figure it out.

NEXT: What if I convert and then the market tanks?

Last updated September 16 2008: 11:34 AM ET

Source: Money research.

Example assumes 28% tax bracket. 1Include after-tax contributions to your 401(k) if you've rolled those contributions into any IRAs.

Example assumes 28% tax bracket. 1Include after-tax contributions to your 401(k) if you've rolled those contributions into any IRAs.