GDP: 2.3%

Inflation: -2.2%

Unemployment: 5.7%

Markets: 15.4%

Interest rate: 0.1%

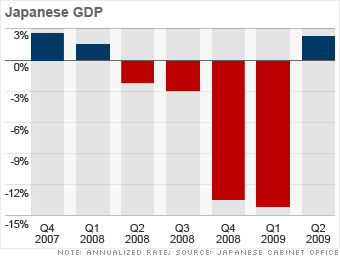

Japan's economy made a major comeback in the last quarter, emerging from a recession after a massive double-digit decline in GDP in the first three months of the year.

Japan's $275 billion stimulus package was largely credited with the rebound. The plan included massive public-works projects, a cash-for-clunkers program and sending consumers checks amounting to about $130 each. That helped drive consumer spending up last quarter for the first time since last October.

But economists are cautious about labeling Japan's economic turnaround as a true recovery, as businesses cut inventories so low in prior quarters that production had little place to go but up.

Experts also worry about the increasing rate of deflation, unemployment rising to a record high last month and jobless rates that are projected to rise past 6% next year.

And there's another concern: All of Japan's fiscal stimulus has grown the debt-to-GDP ratio to an astronomical 200%, which many economists believe is unsustainable.

NEXT: China: Massive stimulus

Last updated September 24 2009: 11:03 AM ET

Source: IMF, national statistics offices, central banks, Nikkei 225