Consumer credit limit crackdown

As banks put the brakes on borrowing, credit cardholders are finding their lines of credit getting dramatically reduced as well.

NEW YORK (CNNMoney.com) -- After a weekend getaway in New York City, Joseph Lanza logged onto his Bank of America Visa account and was shocked to see that his line of available credit had been reduced to $1,000 from $3,800.

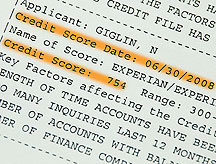

Because of the recent charges from his trip, his balance was $970, dangerously close to his credit limit. "I had been trying to pay my debt down to improve my FICO score and also my debt-to-credit ratio," said Lanza, 26, who works at an investment firm in New Hampshire.

But despite making timely payments and keeping careful track of each charge, he said, "It feels like I'm running up against a bunch of walls."

Betty Riess, a spokeswoman for Bank of America, said she was unable to address the specifics of Lanza's account, but she did say the bank is "taking a more aggressive look at accounts to control risk, given the current environment."

Credit card issuers have been reining in credit limits lately "to minimize their risk because the economic climate has changed so dramatically," explained Bill Hardekopf, chief executive of the card rating site LowCards.com.

In the midst of a financial crisis, banks have less money to lend. On top of that, the percentage of people who are delinquent on their credit card payments rose 12% in the second quarter from the same period a year ago, according to credit reporting agency TransUnion LLC.

So to mitigate rising risk and compensate for less credit overall, issuers are scaling back consumer credit lines - sometimes by more than 50%, according to the American Bankers Association (ABA), a bank industry trade group.

In fact, 62% of credit card issuers have cut back the lines of credit they make available to consumers, according to a recent report by Javelin Strategy & Research, which advises the financial services industry.

That means that consumers across the board are suddenly finding out the hard way that their limit is not what it used to be.

Consumers with better credit histories and high credit scores are less likely to get hit with a sudden restriction on their credit limits, but it can happen to anyone, according to Carol Kaplan, a spokeswoman from the ABA.

"Credit lending standards are tightening across the board, it doesn't matter how great your credit score is," Kaplan said. "This is happening everywhere, to everyone."

In the past, banks have used unsolicited credit-limit increases as a marketing tool to keep their customers happy, according to Ben Woolsey, director of marketing and consumer research at CreditCards.com, a card comparison Web site. But that tool "appears to have dried up along with the 0% APR introductory periods," he said.

Customers like Lanza, who have their limit lowered, now have less available credit. That means their buying power is slashed and they are more at risk of exceeding their limit and getting hit with a hefty fee in addition to a higher annual percentage rate (APR). Over-the-limit fees usually range between $25-$35 a pop and some default APRs are as high as 30%-32%, according to Hardekopf.

With a lower limit, consumers are also more likely to use up a greater percentage of their available credit each month (or debt-to-limit ratio), which has negative effects on their credit score and ability to get loans.

The debt-to-limit ratio is calculated by dividing what consumers spend each month by their credit limit, and it's a key component of credit scores. If your limit drops to $1,000 from $2,000 and you continue spending $500 a month, your debt-to-limit ratio immediately jumps from a favorable 25% to an unfavorable 50%.

As a result, lenders may increase your APR or deny you a loan, even if you continue to pay your balance off every month and never exceed your limit.

Even though the good old days of sky-high credit are over, there is recourse for consumers to improve their financial picture.

For starters, be aware of what your limit is. It can change from one billing cycle to the next. Although credit card issuers are required to disclose any change in a consumer's credit limit before it takes effect, "it's a fine print thing," said Hardekopf.

If you discover that your limit has been lowered, try calling and asking a customer representative to raise it again. You may have to speak to a supervisor or a representative in the retention unit, but your card company might be willing to restore your limit in hopes of hanging on to your account.

If not, "threaten to leave and be prepared to mean it," Woolsey suggested. Chances are, there are other credit card issuers out there are willing to bear more risk and grant you a higher credit line. ![]()