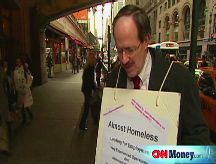

Job outlook gets gloomier

Conference Board report forecasts that job losses could surpass 3 million by mid 2009.

NEW YORK (CNNMoney.com) -- The already bruised labor market could see further losses, according to a report issued Monday by a leading business research organization.

The Conference Board's Employment Trends Index (ETI), which combines a number of readings on jobs and unemployment, fell to 102.9 in November, down 1.6% from October's revised figure of 104.5.

The Index has fallen 13% from a year ago.

"Thus far the U.S. economy has lost 1.9 million jobs and the declines in the ETI suggest job losses could very well surpass 3 million by mid 2009," said Gad Levanon, Senior Economist at The Conference Board, in a written statement.

One result of a soft job market could be less competitive wages. "The continued deterioration in the labor market will exert significant downward pressure on wages," said Levanon, in the release.

The ETI is a combination of eight labor-market indicators from various institutions. It includes data such as the percentage of respondents who say that jobs are hard to get, the number of people who file for unemployment insurance for the first time and the percentage of firms with positions they are not able to fill, among other various employment data.

The report comes on the heels of the government's report which showed that in November, the U.S. economy shed 533,000 jobs -- the largest monthly decline since December 1974 -- bringing the year's total job losses to 1.9 million. In the 2001 recession, the economy lost only 1.6 million jobs.

The annual unemployment rate also increased to 6.7% in November, from 6.5% the prior month, according to the government report.

And so far, this month is not looking much better. In the first week of December alone, a handful of companies announced around 34,000 job cuts.

On Friday, General Motors (GM, Fortune 500) said it planned to lay off 2,000 workers next year. On Thursday, AT&T (T, Fortune 500) said it would slash 12,000 jobs, or 4% of its total workforce. Credit Suisse Group (CS) said it would cut 5,300 staff jobs, or 11% of its global work force. DuPont (DFT) announced 2,500 cuts and Viacom (VIA), said it would cut 850 jobs, or 7% of its workforce.

The job cuts have already started this week, with Dow Chemical Co. (DOW, Fortune 500) stating Monday that it will shed 5,000 jobs.

Robert Brusca, chief economist at FAO Economics, said that more job losses are expected in coming months, but, based on historic recession cycles, the severity of the most recent month of job losses was an indication that the recession was closer to the end of the cycle than the beginning. ![]()