Climbing your way out of debt

Gerri answers readers' questions about debt, unemployment benefits and education tax credit.

|

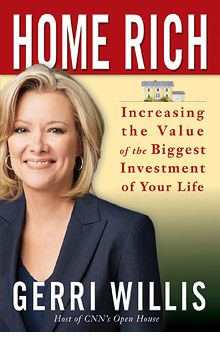

| For more information on managing your largest investment, check out Gerri Willis' 'Home Rich,' now in bookstores. |

| MMA | 0.69% |

| $10K MMA | 0.42% |

| 6 month CD | 0.94% |

| 1 yr CD | 1.49% |

| 5 yr CD | 1.93% |

(CNN) -- QUESTION 1: I have $77,000 unsecured debt. I am thinking about doing debt settlement. Can you tell me which are the best debt settlement companies? -- Ibrahima

Choosing the "best" debt settlement company is kind of like asking which is the best prison to go to, says John Ulzheimer of Credit.com. There are no good debt settlement companies, not because they're inherently bad but the services they offer are very damaging.

The truth is that whatever a debt settlement company can do for you, you can do yourself for free. Credit card companies are more and more likely these days to accept less than what you owe. With your kind of debt load, you may consider talking to a credit counselor who can put you on a debt management plan. You may even be referred to a bankruptcy attorney.

QUESTION 2: I live in one of the high unemployment states. Can you tell me if there is a fourth unemployment extension for us? I will exhaust all of my benefits at the end of September. I hope that there is another extension, because I look for a job every day and I still haven't found anything. -- Tony

Right now an unemployed worker can get up to 79 weeks of benefits. But it's also estimated that 1.5 million people across the country would use up their unemployment benefits may use up their benefits by the end of this year. Right now there is pending legislation that would extend benefits, probably for another 13 weeks for people who live in high unemployment states. That legislation will be taken up next Wednesday in Congress.

To keep up with the developments in Washington DC, check out unemployedworkers.org. In the meantime, check out your local Goodwill store, which can provide you with job training and resources for childcare, transportation and financial literacy. To find one in your area, call 1800-664-6577 or go to goodwill.org.

QUESTION 3: I was in college for spring 2009. Do I still qualify for the $4,500 education tax credit or did I have to be enrolled in fall 2009 also to qualify? -- Chris in Georgia

You're talking about the Hope Scholarship tax credit that you can apply to tuition, fees and course material expenses you had during the 2009 tax year. It doesn't matter if you were not enrolled for part of the year -- you need only be enrolled at least half-time for at least one academic period that began during the tax year, according to Mark Kantrowitz of Finaid.org.

-- CNN's Jen Haley contributed to this article.

Talkback: Send your questions to gerri@cnn.com. ![]()