House to take on 'too big to fail'

On Thursday, House lawmakers will start thinking about shaping bills that would prevent future financial crisis. But creating such power comes with risks.

WASHINGTON (CNNMoney.com) -- One year after risky practices by the nation's biggest banks almost brought down the economy, many of those institutions are even bigger -- and some say even riskier.

A key committee released a proposal Tuesday that finally tackles the issue.

The draft legislation, from the House Financial Services Committee, aims to better watch and take over those institutions currently deemed "too big to fail."

The watching over part is called "systemic risk" regulation, and the taking over part is called "resolution authority."

Financial experts and economists agree that this part of regulatory reform is among the most critical to preventing the kinds of problems that caused the financial crisis.

Most observers, including those in the financial services industry, agree that government officials didn't have the right tools to properly manage the failures of giants Lehman Brothers and American International Group.

"To address the extremely serious problem posed by financial firms perceived as 'too big to fail,' legislative action is needed to create new mechanisms for oversight of the financial system as a whole," Federal Reserve chairman Ben Bernanke said in a speech last week.

The House move on the legislation is a preliminary step in a process expected to take months. House leaders have said they hope to have a final vote on all the different parts of regulatory reform before Thanksgiving. Meanwhile, the Senate has yet to release any legislation on the topic, but several senators have talked about ideas that clash with those in the House and the White House.

The Obama administration's proposal, released this summer, was over 250 pages long and offered up numerous changes. The House version reflects many of the same ideas with some tweaks. Some main provisions include:

- Stronger, and in some cases, new federal supervision of the largest nonbanking financial firms that previously weren't regulated.

- New fees from firms with more than $10 billion in assets to fund the new takeover powers.

- Creation of a new oversight council that would look out for major problems at these nonbanking firms.

- Stronger capital requirements for the largest financial intuitions.

- New powers to allow regulators the same kind of ability to take over giant financial firms the way the Federal Deposit Insurace Corp. manages the failure of smaller banks.

One of the trickiest parts is the last one, called resolution authority.

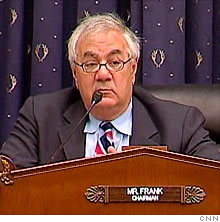

"I think the resolution authority is probably the hardest," Rep. Barney Frank, chairman of House Financial Services, said last Thursday, after his committee passed a bill that would establish a Consumer Financial Protection Agency -- a move Frank called the "second hardest."

His concern is the same as many economists and financial experts watching these things: Finding the right balance.

"Finding the balance, so you have effective resolution authority, but without money going to people who shouldn't get it -- without rewarding people who screwed up, that's an intellectually difficult issue that we're making some progress on," Frank said.

There is also a concern about giving government too much authority to pick winners and losers after a failure -- for example, deciding which creditors get paid and how much.

"It's a very useful authority to have, to be able to tell debt holders, you're going to get 80 cents instead of 100 cents ... or turning an insolvent firm into a solvent firm," said Phillip Swagel, an economist and former assistant Treasury Secretary who teaches at Georgetown University. "But the potential for mischief is very high." ![]()