Search News

Click chart to view Treasurys and yields.

Click chart to view Treasurys and yields.

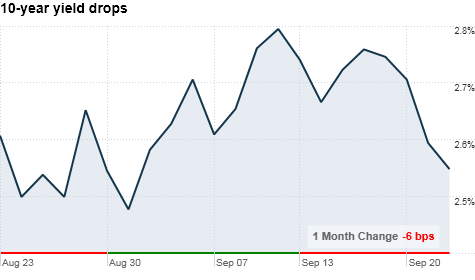

NEW YORK (CNNMoney.com) -- Treasury yields ended mixed Wednesday, a day after the Federal Reserve voiced concern about deflation and said it was prepared to provide additional support to the economy, if needed.

"After evaluating the Fed's statement, the market is focused on the explicit reference to inflation being below the level of the Fed's mandate," said Richard Bryant, head of Treasury trading at MF Global.

Yields on short-term Treasurys bounced back slightly by the end of the day, but still remained near record lows. The 5-year yield edged up to 1.32% after nearing its all-time closing low of 1.26% earlier in the day. The 2-year yield ticked up to 0.44%, continuing to sit near its record low of 0.43%, which it hit Tuesday.

Meanwhile, yields on longer-dated Treasurys sank, pressured by the Fed's comments about inflation remaining low. The yield on the benchmark 10-year note fell to 2.55% from 2.58% late Tuesday, while the 30-year bond yield dropped to 3.74% from 3.79%.

"[Investors] took the Fed at its word that it would provide additional support if necessary, and seem to have concluded that the Fed has adopted a decidedly more dovish approach to the market," Bryant said.

The Fed previously announced a plan to reinvest proceeds from its portfolio into Treasurys, but Tuesday's statement went one step further. The Fed said it was willing to resume buying Treasurys outright if -- a practice known as quantitative easing -- if the economic recovery stagnates.

The economy will have to show significant signs of improvement before the Fed issues its next rate decision if that's to be avoided.

"At this point it feels like the onus is going to be on the data to be stronger to halt any further action," Bryant said. "Each piece of data between now and the next FOMC meeting is going to be examined extremely closely to gain insight about what the Fed's next move will be."

The next Fed policy meeting is a two-day event, starting Nov. 2.

Rush to Treasurys, junk bonds: If data fail to improve, the Fed may be forced to introduce additional measures to support the economy, Bryant said. That means prices on longer-dated securities like the 30-year bond and 10-year note would likely keep rising, driving yields lower.

"We already have historically low yield levels at the front end of curve with the 5-year and 2-year [notes]. But the longer-dated securities like the [30-year] bond and 10-year note have a lot of room to rally, since their yields are still well off their all-time lows," Bryant said.

Treasurys aren't the only attractive investment out there at the moment. As corporate default rates ease, investors are also rushing to junk bonds.

At the end of last week, corporate junk bond issuance for the year soared past the full-year record of $162.6 billion set in 2009, jumping to $173.6 billion on Monday, according to research firm Dealogic.

On top of record issuance, the default rate on high-yielding bonds already dropped to 5.1% last month from 13.2% a year ago, according to Moody's Investment Services. And it's expected to fall to 2.8% by the end of the year. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |