Search News

Click chart to see how other commodities are faring.

Click chart to see how other commodities are faring.

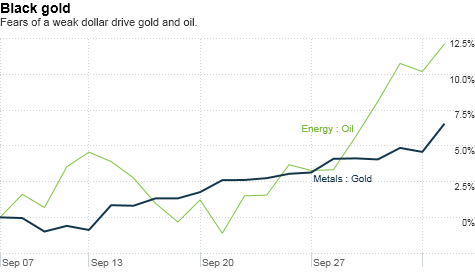

NEW YORK (CNNMoney.com) -- Commodities rallied Tuesday, fueled by a weak dollar and fears of currency intervention by U.S. and Japanese governments.

Gold, oil, silver, and copper -- all of which are priced in dollars -- surged to new highs. Gold ended the day with a record close of $1,340.30 an ounce, after hitting an intraday high of $1,342.60.

William Adams, commodities and metals analyst with Fastmarkets.com in the U.K., said the recent surge has been fueled, in part, by the belief that the United States will engage in quantitative easing - when the government buys securities to increase the money supply. More supply would put further pressure on the already weak dollar.

Those worries gained momentum after the Bank of Japan said Tuesday that it would purchase about $60 billion of government bonds and other assets to boost its national recovery.

"Seeing the Bank of Japan doing some easing increased the perception that the U.S. would do more quantitative easing as well," said Adams.

Joe Foster, portfolio manager for the Van Eck Global International Investors gold fund in New York agreed. "When you get that sort of sentiment, where do you go?" he said.

It's not just gold attracting investors' attention. Oil settled at a 5-month high of $82.82 a barrel Tuesday, and copper continues to trade around a 27-month high. Silver is also at new highs above $22 an ounce, its highest level since the early 1980s.

"If you push down on water, something else is going to pop up somewhere," Adams said.

How long will it go on? Without any strong signs that the economy is picking up, analysts see no reason for the rally to slow down.

"I wouldn't be surprised if we saw $1,360 [per ounce of gold] this week," said Carlos Sanchez, precious metals analyst at CPM Group in New York. "I think we'll see $1,400 by the end of the year."

Foster was even more bullish about the precious metal. "I think we've got our sights on $1,400 to $1,500 in the next three to six months," he said.

Part of what's driving the recent run is that gold remains miles away from its true peak, when adjusted for inflation. Gold hit its real record on Jan. 21, 1980, when it rose to $825.50 an ounce. Adjusted for inflation from 1980 dollars to 2010, that translates to an all-time record of $2,184.08 an ounce. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |