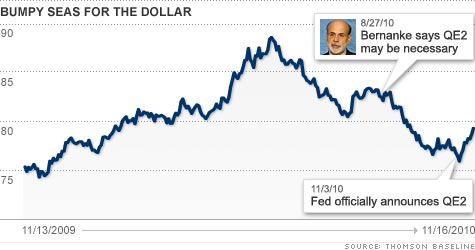

The U.S. Dollar Index plummeted on speculation about the Fed's quantitative easing program. But the dollar has actually rallied in the two weeks after QE2.

The U.S. Dollar Index plummeted on speculation about the Fed's quantitative easing program. But the dollar has actually rallied in the two weeks after QE2.

NEW YORK (CNNMoney.com) -- It's hard to find someone that isn't criticizing the Federal Reserve these days. I keep expecting to see a press release from Lady Gaga in my inbox about why she thinks quantitative easing is the financial equivalent of a bad romance.

The big concerns among all the Fed-haters was that QE2 would keep long-term interest rates too low for too long and further weaken the already puny dollar.

But now that two weeks have passed since the Fed's oft-lampooned decision to buy $600 billion in long-term Treasuries, it's worth pointing out that the worst-case fears have yet to be realized. Bond yields are higher and the dollar has gotten stronger.

Let's look more closely at the greenback. The U.S. Dollar Index has risen 3% since November 3, a move that probably would have been considered impossible a few weeks ago.

However, experts said it's important to put the dollar's "surge" in context. The U.S. Dollar Index plummeted more than 7% in about two months after Fed chairman Ben Bernanke first raised the idea of QE2 being necessary during a speech in Jackson Hole, Wyo. in late August.

So the weakness that everyone was predicting for the dollar did take place -- in September and October, in anticipation of the Fed announcement.

Still, it's silly to suggest that QE2 is a failure because of how the dollar and bonds have performed in just a two-week stretch. With that in mind, some think that the dollar will eventually start sliding again.

"Quantitative easing is almost universally viewed internationally as a ploy to weaken the dollar since the Fed is trying to create inflation," said John Derrick, director of research for U.S. Global Investors San Antonio."In the long run, a weaker dollar is still the trend."

With the Fed committing to purchase long-term bonds, Derrick said it's hard to imagine how much more yields and the dollar can rise.

"At the end of the day, you don't fight the Fed. I think the Fed will be successful in keeping rates and the dollar down," he said. "Nothing goes up or down forever."

The dollar may also be benefiting in the short term from renewed fears about sovereign debt problems in Europe. The Fed and QE2 have quickly taken a backseat to worries about Ireland's financial health and whether it will need (or even accept) a bailout.

"The foreign exchange markets are obsessed with the debt crisis in Europe. Until we get a resolution to that, the dollar will do well," said Kathy Lien, director of currency research at GFT, a foreign exchange and futures brokerage firm in New York.

Lien said that she thinks the dollar will resume its fall against the euro and other currencies once Ireland finally accepts some sort of financial aid package.

Still, the mere fact that the euro is tumbling as the PIIGS make an unwelcome return to financial headlines is interesting.

It wasn't that long ago that currencies around the world were operating in a sort of Bizarro world. Good economic news in the United States was considered bad for the dollar, for example, because it meant investors would sell the greenback in order to embrace riskier assets.

So the euro's fall may actually be an encouraging sign since it represents a more normal reaction by currency traders. Bad economic news for Ireland should be viewed as bad for the euro.

"Currencies, over time, should reflect the relative strength of the economies of the countries where that currency is issued," said Jerry Webman, chief economist with OppenheimerFunds in New York.

Webman said the dollar should continue to rally because it appears that the U.S. economy is recovering, although he tempered his enthusiasm by describing the rebound as a "limp but consistent growth path."

He added that some currency traders overreacted before QE2 was announced and that political pundits and foreign officials at last week's G-20 summit in Korea criticizing the Fed were doing the same.

Webman said the Fed's bond-buying plan is still way too small to risk creating another major asset bubble. He just thinks that it is a necessary move to prevent the U.S. economy from backsliding.

"The market seems to be saying that QE2 is ok since it takes deflation off the table. In a funny way, the rally in the dollar is a vote of confidence in the U.S. The risks of QE2 aren't as big of a deal as people thought."

If Webman is right, that bodes well for the dollar and U.S. economy.

But the problem is that the dollar's fate is no longer tied to just what's going on in the United States.

Bob Gelfond, CEO of MQS Asset Management, a global macro hedge fund based in New York, said it's difficult, if not impossible, to figure out with certainty where the dollar is headed.

"How much of the recent dollar strength is attributable to the crisis in Europe and how much due to the fact that the market had anticipated QE2 since August?" he said. "There are concerns of a slowdown in China as well. There's more than one thing going on globally and it's all a bit tangled."

That's why Gelfond said the only thing that seems certain is that the dollar and other currencies are likely to keep gyrating wildly.

"You're likely to see more up and down moves and increased volatility," he said.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |