Search News

NEW YORK (CNNMoney.com) -- It was only last week that investors were spending all their time analyzing the outcome of the midterm elections, the Federal Reserve's quantitative easing announcement and the October jobs report.

How quaint.

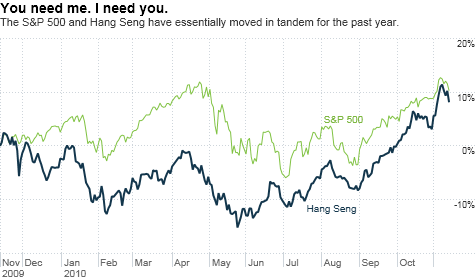

The market has quickly shifted from an all United States, all the time approach to a focus on the rest of the world. And investors don't like what they see.

Sizzling inflation numbers out of China have raised fears that China's central bank will pull an anti-QE2 and raise interest rates soon. China's stock market plummeted Friday as a result.

At the opposite end of the economic spectrum, investors are growing increasingly concerned about sovereign debt woes in Europe again. For the time being, Ireland is the country in the Not-so-Fab-Five group of PIIGS nations that appears to be the biggest risk in the fragile eurozone.

Finally, the G-20 meeting in South Korea ended Friday much like the famous T.S. Eliot quote: not with a bang but a whimper. The group's communiqué was filled with a lot of nice sounding promises to cooperate and collaborate. All that was missing was the chorus to Kumbaya.

But the G-20 meeting did nothing to resolve the numerous concerns about trade and currency manipulation that existed before the summit.

The good news, if you could call it that, is that stocks in the United States only fell slightly Friday morning. It's encouraging that the sell-off was not truly awful given the more sizeable drops in some Asian and European markets.

Still, investors are going to need to continue keeping a close eye on the rest of the world. The tensions between developing and emerging markets are likely to be an overhang on the markets for some time.

"The lesser developed countries in Europe are ugly. Portugal and Ireland worries have been beneath the surface for a bit but are back," said Matt O'Reilly, chief investment strategist with Bridgeport, Conn.-based People's United Wealth Management. "And the larger concern continues to be China and the way they approach their currency."

China has come under fire from the United States for keeping the value of its currency, the yuan, artificially low. The concern is that a cheap yuan makes it tougher for U.S. manufacturers to compete with Chinese exports.

Exhibit A in that argument is the fact that China recently reported a $27.2 billion trade surplus while the United States posted a $44 billion trade deficit.

But at the same time, some think the U.S. is also taking steps to devalue the dollar. The stated intent of the Fed's $600 billion bond-buying program is to keep long-term interest rates low. A byproduct of this policy should be a weaker dollar.

Rob McIver, manager of the Jensen Portfolio in Portland, Ore., worries that the rhetoric between the United States and China could become too heated and lead to isolationist economic policies.

"It all boils down to jobs whether you are in the U.S., Europe or China. Now that we are coming out of a challenging economic period worldwide, some economies are trying to accelerate their recoveries," McIver said.

"One of our biggest concerns is politics," he added. "If the subpar recovery in the U.S. were to translate into protectionist policies, that would be bad news. Bad things happen in the long-term if you put up barriers to global trade."

One can only hope that cooler heads prevail and the leaders of developed and emerging market economies actually do follow through on the promises to act in a coordinated fashion hammered out at the G-20 meeting.

Along those lines, Pierre Lapointe, global macro strategist with Brockhouse Cooper, a brokerage firm in Montreal, said that more potential interest rate hikes by China should be viewed as a positive.

He said that even though there are questions about the value of the yuan, the fact that China is considering a boost to rates is a sign it wants to keep its economy from overheating.

"China wants to keep its manufacturers happy but without killing a recovery. It wants to avoid a boom/bust scenario," Lapointe said.

But O'Reilly said that if China continues to raise interest rates and the United States does not eventually follow suit sometime later next year, that puts the recovery in the markets and economy at risk.

"There should be growing support in the U.S. for the Fed to start increasing rates in 2011. I would be concerned if the Fed didn't do so because of the pressure it would put on the dollar," he said.

Nonetheless, the questions about currency and trade policies should not overshadow the fact that the global economy does appear to be on the mend. The gross domestic product even rose in Europe during the third quarter, albeit at a modest pace.

So while it's reasonable to think that the markets may pull back a bit more on global concerns following a strong run-up since the spring, Lapointe does not think that stocks are due for another massive sell-off.

"The possibility of rate hikes in China and debt fears in Europe are both important and need to be watched closely. But they are not going to derail the global economic recovery and market rebound," he said.

Reader comment of the week: I took a closer look at just how bad the foreclosure exposure for Bank of America could be on Wednesday.

The jury's still out on just how much of a loss BofA may take. But one reader is angry that more hasn't been done by regulators in Washington to crack down on the mortgage operations of big banks.

"The only reason BofA is still afloat is due to the Feds," wrote Wayne Brundrett. "They know exactly what they have done and are still doing yet they are doing nothing. If it wasn't for some of the state attorneys general the public would really be screwed."

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |