Search News

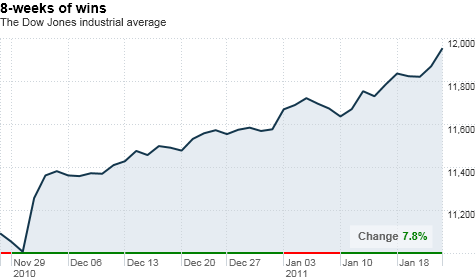

NEW YORK (CNNMoney) -- Stocks got the week off to a solid start Monday, with the Dow slowly clawing its way toward the 12,000 mark.

The Dow Jones industrial average (INDU) closed at 11,980, up 109 points, or 0.9% from the prior trading session.

The blue-chip index has been on an upward trend since Thanksgiving, and is now within a stone's throw of 12,000 -- a level last seen on June 18, 2008.

Meanwhile, the S&P 500 (SPX) gained 7 points, or 0.6%; and the Nasdaq (COMP) rose 28 points, or 1%.

While analysts say a slight pullback could be in the cards soon, companies are reporting strong earnings, which should drive continued positive momentum over the long term.

"American companies are doing quite well, and I think that's going to eventually show up in the employment numbers," said Chad Cunningham, chief investment officer at Iron Horse Capital Management. "If we get any sort of a short-term technical pullback, I think it's a good time to allocate money to U.S. equities."

The rest of the week brings an onslaught of earnings results from blue chip companies, as well as the latest readings on consumer confidence, new home sales and the overall economy. Cunningham said he expects to see slight improvement in all the economic indicators.

Companies: After the bell, American Express (AXP, Fortune 500) reported earnings of 94 cents per share on revenue of $7.32 billion, falling just a hair short of analyst estimates. Its stock fell 1.1% in after-hours trading.

Shares of Amgen (AMGN, Fortune 500) also fell 0.5% in late trading, after the biotech giant announced earnings that barely beat the Street. Earnings from Texas Instruments (TXN, Fortune 500) came in slightly better than expected too, but its stock fell 2.2%.

Earlier during the trading session, RadioShack (RSH, Fortune 500) shares tumbled 11.4% after the electronics retailer forecast a weak fourth-quarter profit and announced its CEO Julian Day plans to retire in May.

The end of the year was tough on electronics retailers, with sales falling below expectations. Last month, Best Buy (BBY, Fortune 500) lowered its outlook for the full year.

JC Penney (JCP, Fortune 500) shares surged 7.2% after the retailer announced it has named prominent hedge fund manager William Ackman and Steven Roth, chairman of Vornado Realty Trust, to its board of directors. JC Penney also said it plans to close six unprofitable stores and continue phasing out its catalog business.

Before the opening bell, Halliburton (HAL, Fortune 500) logged better-than-expected earnings. Shares of the company rose 0.6%.

McDonald's (MCD, Fortune 500) reported earnings in line with expectations. Shares of the fast food chain rose 0.5%.

World markets: European stocks ended their session higher. Britain's FTSE 100 edged up 1.1%, France's CAC 40 rose 0.5% and the DAX in Germany was little changed.

Asian markets ended the session mixed. The Shanghai Composite slid 0.7% and the Hang Seng in Hong Kong fell 0.3%, as Japan's Nikkei ticked up 0.7%.

Economy: There are no major economic reports on tap for Monday.

Currencies and commodities: The dollar rose against the British pound, but fell against the euro and the Japanese yen.

Oil for March delivery slipped $1.24 to settle at $87.87 a barrel.

Gold futures for February delivery rose $2.90 to settle at $1,345.50 an ounce on the Chicago Mercantile Exchange.

Cocoa futures for March delivery jumped 4%, after the Ivory Coast put a one-month ban on cocoa exports.

Bonds: The price on the benchmark 10-year U.S. Treasury rose slightly, sending the yield down to 3.41%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |