Search News

Click the chart for more market data.

Click the chart for more market data.

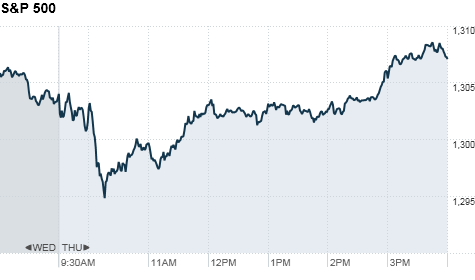

NEW YORK (CNNMoney) -- U.S. stocks ended higher Thursday as investors digested comments about the economy from Federal Reserve chairman Ben Bernanke, who said a weak job market continues to weigh on the recovery.

Stocks have been wavering over the past couple of sessions as investors remain nervous about Friday's big employment report from the government. This week's labor reports painted a mixed picture.

The Dow Jones industrial average (INDU) rose 20 points, or 0.2%, led by Cisco (CSCO, Fortune 500) and Bank of America (BAC, Fortune 500). Earlier, the blue-chip index shed 60 points, but it erased most of those losses ahead of Bernanke's speech.

The S&P 500 (SPX) added 3 points, or 0.2%. Estee Lauder (EL, Fortune 500) was the biggest winner on the broad index, with shares surging more than 14%. The cosmetics maker posted higher-than-expected profit and sales for the second fiscal quarter, and raised its guidance for the remainder of the year.

The Nasdaq (COMP) rose 4 points, or 0.2%. Strength in retail stocks helped the tech-heavy index move higher, as January same-store sales climbed 4.2%. Sears Holdings (SHLD, Fortune 500) and Ross Stores (ROST, Fortune 500) were among the big gainers on the Nasdaq, with shares gaining about 6%.

Limited Brands (LTD, Fortune 500), Gap (GPS, Fortune 500), Nordstrom (JWN, Fortune 500) and Costco (COST, Fortune 500) were also higher.

During a luncheon at the National Press Club in Washington,Bernanke defended his controversial bond-buying policy. But he also cautioned that, while the economy is on the mend, unemployment remains an issue.

"Bernanke said that it's going to take a long while to get people back to work, but nothing in his comments was a surprise," said Brian Battle, vice president at Performance Trust Capital Partners. "The market's next move will come after the employment number tomorrow."

The government report due before the bell Friday is forecast to show that employers added 148,000 jobs in January, up from 103,000 in December. Economists are expecting the jobless rate to tick up to 9.5% after falling to 9.4% in the previous reading.

Stocks ended little changed Wednesday, as uncertainty about Egypt hung over the market -- two days before the government's all-important jobs report.

Economy: The U.S. government report on weekly jobless claims was slightly better than expected, with 415,000 Americans filing new claims for unemployment in the week ended Jan. 29.

A report from the Commerce Department showed that factory orders rose 0.2% in December. Orders were forecast to have dropped 0.6%, after increasing 1.3% in November.

The ISM services sector index for January rose to 59.4. Economists were expecting the index to have decreased to 57 from 57.1 in December; any reading over 50 indicates expansion in the sector.

Companies: Shares of Dow component Merck (MRK, Fortune 500) dropped 2.7%. The drugmaker logged a quarterly loss that slightly beat expectations but issued a cautious outlook for the full year.

Shares of Ameriprise Financial (AMP, Fortune 500) fell more than 6.9% after the Minneapolis-based money manager's fourth-quarter results badly missed expectations.

Shares of KFC-parent Yum Brands (YUM, Fortune 500) added 3.1%, a day after the company reported strong earnings.

World markets: European stocks ended mixed. Britain's FTSE 100 edged down 0.3% and France's CAC 40 slipped 0.7%. Germany's DAX edged slightly higher.

Japan's Nikkei ended 0.3% lower. Markets in much of the rest of Asia -- including Shanghai and Hong Kong -- were closed for lunar new year celebrations.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for March delivery slipped 21 cents to settle at $90.54 a barrel.

Gold futures for April delivery added $4 to settle at $1,336.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, with the yield rising to 3.54%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |