Search News

Stocks keep chugging along.

Stocks keep chugging along.

NEW YORK (CNNMoney) -- The resignation of Egyptian President Hosni Mubarak gives stocks one more reason to continue heading higher in the coming week.

Uncertainty still reigns over the transition and what the new Egyptian government will look like, but Wall Street is breathing a sigh of relief for now as worries about escalating violence and unrest in the region fade.

"We've swerved around another pothole," said Burt White, Chief Investment Officer of LPL Financial. "We're on our way to finding a future state in Egypt, and that's definitely lowering the blood pressure of investors."

That doesn't mean there won't be more stress, he warned.

Like the sovereign debt crisis in Europe that continues popping up and spooking investors, more worries about political unrest may erupt in the coming week -- especially if other countries decide to follow Egypt's lead.

"We don't know what the future state of Egypt is going to look like," White said, "so markets are going to be looking at that closely and continuing to watch carefully to make sure it doesn't cross borders into other parts of the region."

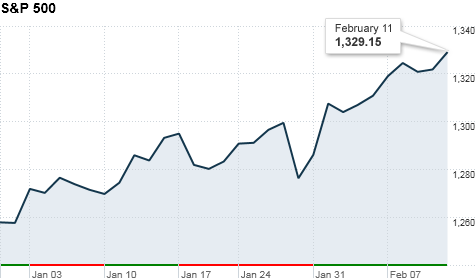

But even with escalating tensions across the Middle East, the major indexes have risen more than 2% so far this month and ended at multi-year highs on Friday. Markets have been posting big monthly gains since August, when Federal Reserve Chairman Ben Bernanke introduced a second round of quantitative easing designed to pump $600 billion into the economy.

"We're going to just keep going higher," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "It's going to take something big to stop this momentum, and it's not going to be Egypt, it's not going to be Spain -- we've been through all that -- it'll be when the Fed finally hints it's going to be stopping the money-printing machine."

This week, investors will be looking at some key economic readings due out from the government for any hints of just when Bernanke may pull the plug.

"We want to find out how robust the economic growth party has been, because the stronger the party, the stronger the hangover," said White. "We're really looking for a Goldilocks number, because if it's too high, people will worry that the Fed is closer to slowing this money train down -- but then if it's too low, people will be wondering if QE2 is really working."

On the docket

Monday: Kicking off the week is President Obama's proposed 2012 federal budget in the morning. The plan will call for $1.1 trillion dollars in deficit cuts over 10 years.

While it's not clear yet where all the cuts will come from, the plan is expected to call for cutting $100 billion dollars from the Pell grant program and other higher education initiatives,eliminating $2.5 billion from a program that helps low-income people cope with high energy costs and limiting tax breaks for the rich.

No other market-moving economic reports are scheduled, but quarterly results are due from MGM Resorts (MGM, Fortune 500) and Marriott (MAR, Fortune 500).

Tuesday: The Commerce Department reports on retail sales before trading starts. Sales are expected to have gained 0.5% in January after having increased 0.6% in December. Sales excluding volatile autos are expected to have ticked up 0.6% after a 0.5% rise the previous month.

After the opening bell, the National Association of Homebuilders is scheduled to release its preliminary housing market index for February. The index is forecast to remain at 16.

Other economic reports on tap before the market opens include data on export and import prices, along with business inventories.

Qwest (Q, Fortune 500), Sirius XM Radio (SIRI), Dell (DELL, Fortune 500) and Tesla Motors (TSLA) are all on deck to report quarterly results.

Wednesday: A report on January housing starts and building permits comes out in the morning. Economists expect 540,000 homes broke ground in the month, up from 529,000 in December.

Building permits are expected to dip to 580,000 from 635,000, according to consensus estimates from Briefing.com.

The Producer Price Index, a measure of wholesale inflation, is due out from the Commerce Department at the same time. The index is expected to have edged up 0.7% in January after jumping 1.1% in December.

The so-called core PPI, which strips out volatile food and energy prices, is expected to have risen 0.2% after increasing by the same amount in the previous month.

Reports on crude inventories and mortgage purchases are also on deck, while results are due from Cablevision (CVC, Fortune 500), Comcast (CMCSA, Fortune 500) and CBS (CBS, Fortune 500).

Thursday: The U.S. consumer price index, the government's main inflation gauge, is expected to show that prices rose 0.3% in January, slightly less than the 0.5% increase in December.

Economists expect consumer prices excluding food and energy to inch up 0.1%, matching the previous month's increase.

The government's weekly report on initial claims for jobless benefits is expected to show an uptick to 410,000 from 383,000 in the previous week.

An index on leading economic indicators for January is expected to increase 0.2%, after a 1% rise the month before.

Also out in the morning is the preliminary Philadelphia Fed index for February, a regional reading on manufacturing. The index is forecast to rise to 21.9, up from 19.3.

Intuit (INTU), Nordstrom (JWN, Fortune 500) and Duke Energy (DUK, Fortune 500) are on tap to report results throughout the day.

Friday: No market-moving economic reports are scheduled to be released. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |