Search News

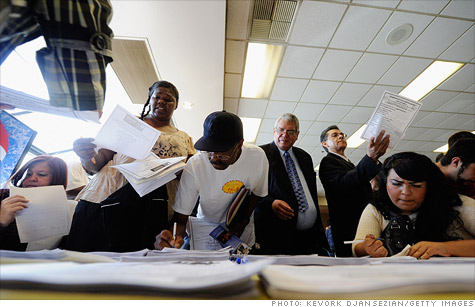

Job seekers at a Los Angeles jobs fair.

NEW YORK (CNNMoney) -- Experts worry that the risk of falling into another recession has increased, according to a CNNMoney economic survey.

To be sure, economists still place long odds on that worst case scenario. But the odds are a lot less long than they were just a little while ago.

And the trend of a weakening economy is clear: most of the economists surveyed, even those who are not worried about a recession, have cut their forecasts for growth in the second quarter sometime during the last month. Many are trimming estimates for the full year as well.

A CNNMoney economic survey of 18 leading experts found they think there is about a 15% chance of a new recession. That's about double the chance they believed existed at the start of the year.

"The fragile U.S. recovery means the economy is much more vulnerable to geopolitical shocks and a rise in fuel prices," said Bernard Baumohl of the Economic Outlook Group, a Princeton, N.J., research firm. "Since the instability in Middle East is far from over, there are real risks for the U.S. and international economy."

The gloomier outlook of recession in the economic survey comes as most readings create a drumbeat of bad news, showing hiring grinding to a near halt, home prices continuing to slide to a new post-boom low, and a slowing of consumer and business spending.

High prices for gas and food have taken a bite out of consumer confidence and there are worries among economists about the threat of other external shocks, such as a possible debt default by the Greek government, that would ripple through the world's financial system.

Still, Baumohl said he thinks there is a "less than 20%" chance of a new recession. But he said at the start of the year there was no chance.

Many other economists said the weakening of the economy in recent months in the first half of the year has changed their outlook.

"We came off a great Christmas and some nice jobs reports," said Gary Rosenberger of EconoPlay. "Then came storms and tsunamis and tornadoes. Who would have guessed that the economic recovery would hinge on the shifting of tectonic plates and global climate change?"

But three of the economists surveyed say they still aren't worried about another recession, putting the chances between 0% and 5%.

The consensus view is that gross domestic product, the broadest measure of the nation's economic health, will grow at only a 2.3% annual rate in the second quarter, a little better than the 1.8% growth in the first three months of the year. A month ago they were still looking for 3% growth in the quarter.

While virtually all the economists are projecting stronger growth in the second half of the year, they've trimmed their forecast for full-year GDP growth to 2.7% from 3% a month ago. The economy posted 2.9% growth for all of 2010.

Nevertheless, only a couple economists said they would support Congress passing a new round of stimulus in order to jumpstart disappointing growth.

Bill Cheney, chief economist at Manulife Asset Management, said he would like to see Congress accelerate military procurement or other government spending on goods and services. Baumohl would like Congress to act sooner rather than later to raise the debt ceiling in order to assure bond investors who might be worried about the threat of default later this summer.

He also would like to see an extension of the payroll tax holiday. But most of the economists, even those most worried about a recession, aren't ready to see Congress spend money or cut taxes to respond to that threat.

"At this point, reduction in (the) budget deficit is more important," said Sung Won Sohn, economics professor at Cal State University-Channel Islands.

There also was scant support for Federal Reserve pumping more cash into the struggling economy when it's done with its purchases of $600 billion in Treasuries later this month.

"Interest rates and liquidity are not critical constraints on the economy at present, so Fed action is unlikely to have much positive impact," said Cheney. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |