Search News

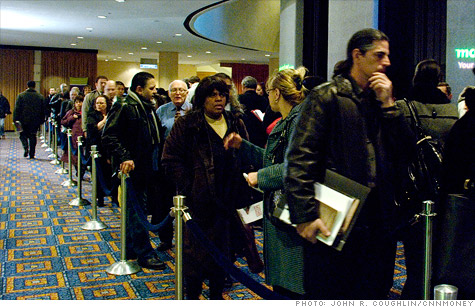

Millions of Americans may lose unemployment benefits in 2012.

NEW YORK (CNNMoney) -- Even though the nation's jobless rate is on the rise, millions of people could see their unemployment checks stop coming at the end of the year.

Nearly all Americans who find themselves out of work starting next month will likely receive only 26 weeks of state unemployment checks -- at most.

Why? Because the deadline to file for extended federal benefits expires at the end of the year.

"Most people who lose their jobs after July 1... won't be eligible for federal unemployment benefits," said George Wentworth, senior staff attorney at the National Employment Law Project.

And as Washington prepares to pull back, a growing number of states are cutting their share of benefits. South Carolina is poised to become the fourth state this year to reduce state benefits to 20 weeks, while Arkansas and Illinois have shorn one week off their unemployment insurance coverage.

Earlier this week, President Obama broached the idea of extending the federal safety net in detailing steps Congress has taken to help unemployed Americans and the overall economy. His comments came just a few days after the government reported surprisingly weak employment growth for May, when the jobless rate rose again to 9.1%.

"One of the things that I'm going to be interested in exploring with the members of both parties in Congress is how do we continue some of these policies to make sure that we get this recovery up and running in a robust way," Obama said Tuesday.

To help the jobless get by during the downturn, Congress extended federal unemployment benefits in 2008 to a maximum of 73 weeks. However, those looking for work have to periodically file for additional benefits to qualify for the full 73 weeks. The deadline to file for those extensions is Jan. 3, 2012.

At the moment, Congress is not thinking much about unemployment insurance. Lawmakers are wrestling with raising the debt ceiling and how to cut the budget -- not spend more.

Advocates for the jobless hope legislators will take up a federal benefits extension in the fall. But it will be a battle to extend them once again.

Last year, when the Democrats ruled Capitol Hill, legislators could only win support for several short-term extensions. Then, in December, Congress passed a measure that pushed the deadline to the end of 2011 as part of a deal to maintain the Bush tax cuts.

This year, with Republicans in control of the House, it will likely be even tougher. The GOP is looking to rein in spending, and jobless benefits are pricey. The federal government shelled out $109 billion for jobless benefits between fiscal 2008 and 2010.

Though no one knows what the unemployment rate will be at the end of the year, more than 4 million people depend on extended benefits at the moment. Another 3.5 million are collecting state benefits, and many will likely apply for a federal extension after their 26 weeks expire.

"More than 50% of everyone collecting state unemployment insurance are exhausting their state benefits without finding a new job," Wentworth said. People "need the financial support during that work search." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |