Search News

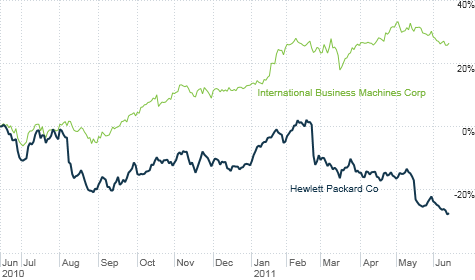

HP has been a market laggard for the past year. But IBM, a company HP is often compared to, has been a stock stud.

NEW YORK (CNNMoney) -- Hewlett-Packard would love to be the next IBM: A mature, megacap tech company that is still winning praise from Wall Street for delivering steady growth.

Unfortunately for HP, it's looking more and more like the next Cisco Systems: A mature, megacap tech company that is shunned by investors for being a muddled mess.

Shares of HP (HPQ, Fortune 500) were one of the biggest laggards in the Dow Jones industrial average in 2010, and that trend has continued. Through Monday, the stock was down 18% year-to-date. The only Dow component to fare worse this year? Cisco (CSCO, Fortune 500).

Meanwhile, Big Blue is chugging along. Shares of IBM (IBM, Fortune 500) are up nearly 12% in 2011. The stock is only about 6% below its all-time high, a stunning achievement for a company about to celebrate its centennial anniversary.

HP, like IBM, has a diverse mix of tech businesses. It's big in hardware, software and consulting services. But like Cisco, HP has been forced to play the corporate restructuring and management shakeup game to convince investors it's on the right track.

The most recent reorganization was announced Monday evening. HP's chief information officer and chief administration officer are out. The latter role is being eliminated entirely.

Three key division heads will now report directly to newish CEO Léo Apotheker, who joined the firm last October after Mark Hurd left in the wake of a scandal. And longtime HP exec Ann Livermore, who many tech insiders thought would be the one to succeed Hurd, was named to HP's board -- but will step down from her current job as head of HP's services business.

What will this all mean for HP and what must be a growing legion of irritated shareholders? The hope is that these moves will help HP focus even more on higher margin areas like software and more rapidly growing businesses like storage and servers. (Apotheker is one of several tech CEOs on the hot seat.)

HP's printing business is a cash cow, but the growth prospects are as exciting as watching paint (or maybe toner cartridge ink?) dry. Then there's the consumer unit. HP's PC sales are down. Making matters worse, the profit margins are notoriously razor thin.

When Apotheker, who had been a former CEO of German software giant SAP (SAP), was named to lead HP, investors immediately assumed that he would want to go shopping for software firms.

HP had made some software deals under Hurd. Some tech experts even argue that HP's curious acquisition of struggling smartphone maker Palm was more about Palm's Web OS mobile operating system than its hardware.

But the new goal for HP was not to beat Dell (DELL, Fortune 500) in the less lucrative business of making gadgets. It wants to target the likes of enterprise software leaders SAP, Microsoft (MSFT, Fortune 500), IBM and Oracle (ORCL, Fortune 500).

"HP has been behind in software for as long as I've followed HP, and I'm an old guy," said Ezra Gottheil, senior analyst with Technology Business Research in Hampton, N.H.. "Software is amazingly profitable and HP needs to do more in that business."

Gottheil said it's a little unfair to judge HP under Apotheker just yet. But he also thinks investors should not punish the company if it does make more deals in software and services -- even if it hurts profits in the short-term.

HP investors got spoiled under Hurd because he was legendary for cutting costs in order to boost profits. The fact that Hurd later joined Oracle and its stock has trounced HP since then is just more salt in the proverbial wound for HP investors.

But Gottheil said HP no longer can afford to hunker down and slash expenses.

"Mark Hurd ran a very tight ship and managed through a recession, which required the company to be extremely lean," he said. "But additional investments are needed."

Jeff Fidacaro, an analyst with Susquehanna Financial Group in New York, said that HP's new strategy should ultimately pay dividends. But investors will have to be patient.

Fidacaro thinks that investors will remain skeptical as long as profits are relatively weak. Analysts expect HP's profits to increase by less than 10% in fiscal 2011 -- which ends in October -- and its earnings growth to slow to about 7% in fiscal 2012.

For that reason, Fidacaro said he still has a neutral rating on HP. Even though shares trade at a dirt -heap valuation of 7 times fiscal 2011 earnings estimates, there's no compelling reason to buy until there's more evidence that Apotheker's bet on software will transform HP.

"It is going to take time for this to pan out," he said. "The stock is probably going to trade in a range for awhile until growth picks up and operating expenses stabilize."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()