Search News

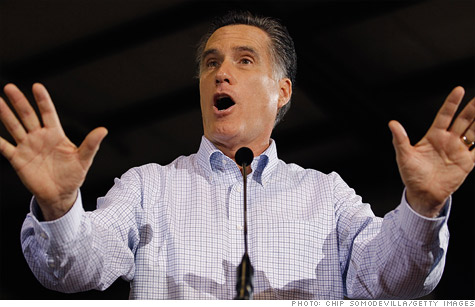

The release of Mitt Romney's tax returns offer an important policy lesson: Investment income should be taxed at the same level as labor income.

Joseph J. Thorndike is a contributing editor at Tax Analysts and a columnist for Tax Notes Today, where a longer version of this article first appeared. He is also director of the Tax History Project at Tax Analysts, which includes an archive of presidential tax returns. The opinions expressed in this commentary are solely his own.

So what did we learn from Mitt Romney's tax returns? On one level, not much. The guy makes a lot of money. Big deal. He shows no wage or salary income; instead, he lives off his investment income. Again, big deal.

All in all, the Romney returns -- all 500-plus pages of them -- are a predictable yawn, at least for anyone seeking scandal and salacious detail.

Still, their release is important. On one level, it provides a measure of reassurance that the candidate is playing the tax game straight, if perhaps a bit aggressively.

But the real value of Romney's disclosure is educational. Tax returns of the rich and famous have a way of highlighting important policy issues that often get ignored in public debate.

In the 1930s, for instance, President Franklin D. Roosevelt leaked the names of well-heeled tax avoiders, as well as details from their tax returns, hoping it would grease the skids for progressive tax reform. The gambit worked.

And in 1969, when the Treasury Department disclosed that 155 high-income households had paid no income taxes, the resulting uproar started the nation on its long and unhappy journey to the modern alternative minimum tax. And that was without specific details about the identities of those taxpayers.

"People are concerned and indeed angered about high-income recipients who pay little or no federal income tax," Treasury Secretary Joseph Barr warned at the time. "I believe public confidence in our income tax system is threatened and that tax reform should be a top-priority subject for the new administration and the 91st Congress."

It should be a top priority for the 112th Congress, too.

Because public interest in the Romney returns underscores something we already know: Americans are deeply dubious about the current tax system. Specifically, they suspect that rich taxpayers are getting a sweet deal.

Romney has turned the spotlight on a key issue of fiscal fairness. And in his case, the specific issue concerns investment income.

Over the last two years, Romney has paid an average tax rate of 14.7%. That's more than most Americans pay but probably less than someone of his substantial wealth should pay (at least judging from the popular reaction to this revelation).

But the real question is why he paid so little. And the answer is the tax break for capital gains.

Generally speaking, realized gains from investments are taxed at 15%. There are a variety of reasons why this low rate might be considered reasonable. It may, for instance, help encourage saving and investment, though the economic data on that point are ambiguous.

Also, the low rate might compensate for the fact that many capital gains have already been taxed at the business level under the corporate income tax. The individual tax break helps alleviate the burden of double taxation.

Even if we accept these justifications for the capital gains tax break, there is at least one very good argument against it: It's simply not fair.

Someone like Romney -- who's living off his investments, not the sweat of his brow -- is making less of a fiscal sacrifice than many other Americans. And I don't mean the great middle class, many of whom are paying pretty low rates, too. (Read: Romney's tax record as governor)

No, he's paying less than many talented CEOs and business owners who take a big chunk of their compensation in the form of salary and wage income.

That's not fair. Investment income should be taxed at the same rate as labor income. And it's not just liberals who feel this way. Once upon a time, conservatives also endorsed this obvious principle. Andrew Mellon, Treasury secretary under three Republican presidents in the 1920s, actually argued that labor income should be taxed less than investment income.

"The fairness of taxing more lightly income from wages, salaries or from investments is beyond question," Mellon wrote. "In the first case, the income is uncertain and limited in duration; sickness or death destroys it and old age diminishes it; in the other, the source of income continues; the income may be disposed of during a man's life and it descends to his heirs."

Mellon was right. Efficiency arguments for a capital gains tax break are simply not compelling, at least not in the face of fairness arguments to the contrary. Americans value success in their leaders, and they don't begrudge them their wealth. But it's time we started to tax that wealth in the same way we tax work. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |