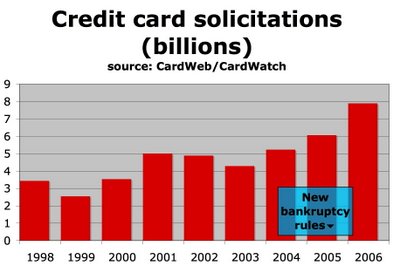

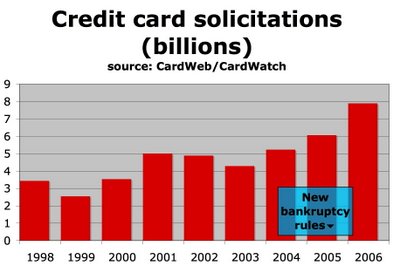

EZ credit! (Until you want out)

This chart pretty much speaks for itself.

Harvard Law School bankruptcy expert Elizabeth Warren points to these numbers in this

blog post at one of my new favorite wonk sites,

CreditSlips.org. Here's Warren:

In 2005, Congress gave the credit industry what it wanted: tighter bankruptcy laws. In 2006, the credit industry responded by mailing out 8 billion credit card solicitations--up 30% from 2005. Larry Ausubel and others predicted during the debates over the bankruptcy laws that if Congress made it tougher to go bankrupt, then lenders would engage in riskier lending as they tried harder to get people to borrow. What kinds of risks are the card companies willing to take on? With about 110 million households in the US, that's about 73 card offers per household. If the average card offers is about $5,000 in pre-approved credit, that about $365,000 in offers for every American household--or about $1000 a day, every day of the year....

If debtors have no bankruptcy option, Ronald Mann points out that creditors can keep them in the sweat box longer. Perhaps if bankruptcy were outlawed altogether the mailings would go to 16 billion, and if debtors' prisons were reinstituted, could the mailings top 25 billion? Ah, the possibilities.

By the way, you can call

(888) 5-OPT-OUT if you want to stop getting these mailings. Click here for more info from the Privacy Rights Clearinghouse.

Do you ever get the feeling that the banks replaced the monarchies, and that we are all their suckers? It would help explain this economic structure they call "Free Market" capitalism. Real "capitalists" control capital; every-else are their laborers.

Karl Marx couldn't have said that better. I repeat free market means free to choose. You are only a "sucker" if you want to be "sucker."

No one twists the arms of the "what-to-be's" who borrow more than they can afford or these X-gens who use credit cards to excess.

Doesn't anyone feel responsible for their own actions? Doesn't anyone realize that wealth almost always takes many years to accumulate, and your children not you may be the ones that enjoy that wealth? You can not borrow your way to wealth unless you are employing people, making some product or service, and making money with the money that was loaned to you. Now that is risky. But thank God we have people who are willing to take that risk. Yeah that's capitalism. Remember?

You can only dig a hole that you may not escape from when you borrow and spend on something that that isn't going to produce income. Now that's not capitalism. That's stupidity.

Don't blame others if they give you the shovel to dig your hole. Blame yourself for taking the shovel.