The greatest returns in the stock market come from taking above-average risks. That's why over periods of a decade or longer, small-company funds - which own shares of small, dynamic companies - can outpace the rest of the market by an average of one to three percentage points a year.

This isn't the only reason to carve out a permanent niche in your portfolio for such funds. They sometimes pick up steam just when blue chips stagnate, making them a great diversifier. In the 1970s, for instance, small stocks delivered nearly twice the gains of blue chips.

"Adding that small-cap performance gives you a nice extra bit of diversification," says Frank Armstrong, founder of the advisory firm Investor Solutions. This category makes particular sense when you're decades from needing to tap your portfolio. The farther off that goal, the more time you have to benefit from small-stock funds' long-term growth, and the less you need to worry about their periodic nosedives.

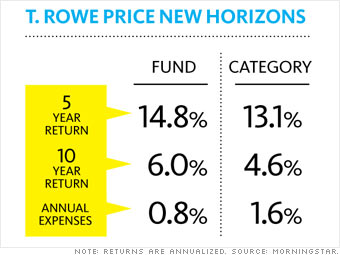

Most of our first-choice picks are index funds, but this one is an exception: T. Rowe Price New Horizons. In this category, it may be worth paying slightly more - just slightly - for active management, and New Horizons is one of the most efficient of the actively managed crowd.

Alternatives: Vanguard Small-Cap Index (NAESX) and Vanguard Small-Cap ETF (VB)

NEXT: A value fund