Special Offer

For the better part of two decades, inflation has been the polio of the American economy: a terrifying danger, to be sure, but one you could confidently say was eradicated. No longer. Since last fall, consumer prices have been more than 4% higher than the year before - a rate we have not seen in nearly 20 years.

Why worry if you have an ample dose of stocks? Because as you get older, you'll gradually reduce your equity stake while boosting your bond allocation, to reflect your greater income needs and the fact that you can't afford to take as much short-term risk as you once could. But inflation eats away more than half of the return of a conventional bond.

Enter funds made up of inflation-protected bonds. These portfolios invest in Treasury Inflation-Protected Securities, or TIPS, which not only pay a predetermined yield but also adjust the value of the bond's principal to preserve purchasing power.

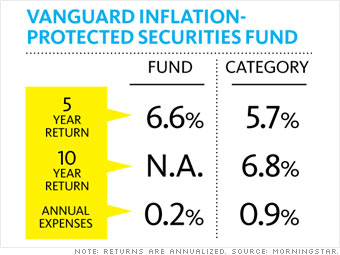

Among TIPS funds, Vanguard Inflation-Protected Securities has several things going for it, including lower costs and better management than you would get if you assembled your own TIPS portfolio. While the fund returned 6.6% over the past five years, you shouldn't expect it to make a pile of dough. Its job is to protect the money you already have.

Alternatives: iShares Lehman TIPS Bond (TIP) and T. Rowe Price Infl.-Protected Bond (PRIPX)

NEXT: A money-market fund

Last updated May 15 2008: 1:29 PM ET