Special Offer

The universe of equities is divided into two groups: growth stocks, which are shares of high-performing companies that often trade at steep prices (relative to their earnings growth or assets); and value investments, overlooked or beaten-down shares selling at discount prices. Why do you need to bother with the bargain-basement bin?

For starters, value stocks typically pay out significantly higher dividends than growth companies. Today, in fact, the average value stock in the S&P 500 yields 3.5% - nearly twice what growth stocks pay out. Dividends give value stocks a steadier source of return than growth funds, which rely almost entirely on the market's opinion. That's one reason that over long stretches, value trumps growth more often than not.

In the equity investors' bible, "Stocks for the Long Run," University of Pennsylvania professor Jeremy Siegel points out that value returned an average of 15.7% a year between 1975 and 2001, nearly two points a year more than growth stocks.

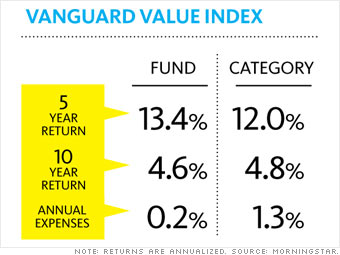

When choosing a value fund, the last thing you want to do is overpay. Vanguard Value Index is a cost-effective way to buy the universe of blue-chip value stocks for just 0.20% in annual fees. The low costs explain how this plain-vanilla fund has returned about 13% a year since 2003, beating 78% of its peers.

Alternatives: iShares S&P 500 Value Index (IVE) and T. Rowe Price Equity Income (PRFDX)

NEXT: A high-quality bond fund

Last updated May 15 2008: 1:29 PM ET