Special Offer

As much as you need stocks, "precious few people can really stomach an all-stock portfolio," says William Bernstein, author of "The Four Pillars of Investing." Equities are essential for long-term growth, but you hardly need reminding in today's market they're not that reliable in the short run.

Bonds will never run the table in performance, at least not when high-quality corporates are yielding around 5.5%, as they are today. So think of the fixed-income funds in our simple portfolio as ballast to make your nest egg more stable. Over the past five years, a portfolio consisting of 80% blue-chip stocks and 20% bonds delivered nearly 90% of the returns of an all-stock portfolio, but with just four-fifths of the risk.

Focus on high-quality bonds, which tend to zig when stocks zag; they've returned nearly 7% a year since 1998, beating stocks in a tough market. As you get closer to retirement, you'll also appreciate the reliable income these bonds pay out.

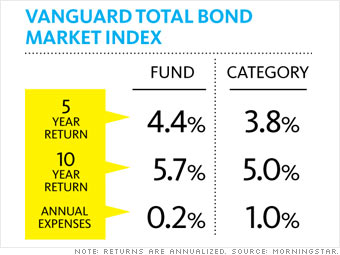

Today you can own the fixed-income universe in one fund, Vanguard Total Bond Market. Since bond funds return less than stock funds, low annual fees are crucial, and in this one they total just 0.19% vs. 1.02% for the average fund. That advantage makes Vanguard's index fund very tough to beat.

Alternatives: Vanguard Total Bond Market ETF (BND) and Harbor Bond (HABDX)

NEXT: An inflation-protected bond fund

Last updated May 15 2008: 1:29 PM ET