Special Offer

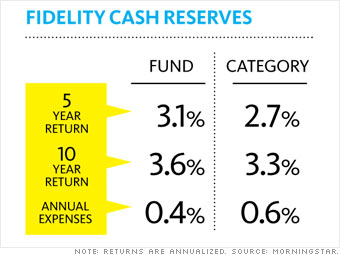

A money-market fund is essentially a cash account. And as we've said in the past, cash is not an investment - it's a place to stash your emergency fund or safeguard money you'll need to spend right away. In fact, over the past decade, the 100 largest money funds returned just 3.6% a year on average, barely keeping pace with the long-term rate of inflation.

So why, then, include it in the only seven investments you need? As an investor, there are times when you'll need to have some cash to manage your portfolio. What if you wanted to take advantage of a buying opportunity in the stock market, for instance? Without some money that's easy to get at, you'd have to sell some stock or bond holdings, possibly triggering taxes.

As you get older, you'll also need an account to safely park the income thrown off by your stocks and bonds. While they don't carry FDIC insurance, money funds are a solid choice. They're about as safe as a bank account, since they aim to maintain principal value. Yet they're more liquid than CDs.

When choosing a money fund, think service and fees. Among the largest funds, Fidelity Cash Reserves has the highest current yield at 2.85% (thanks to modest fees). And Fidelity will let you link a high-yielding checking account to the fund.

Alternatives: Schwab Value Advantage Money (SWVXX) and Vanguard Prime Money Market (VMMXX)

More galleries

Last updated May 15 2008: 1:29 PM ET