Stocks take a tiny step back

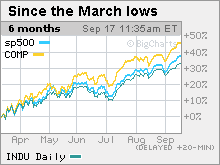

Investors get cold feet after pushing the Dow, S&P 500 and Nasdaq to the highest levels in nearly a year.

NEW YORK (CNNMoney.com) -- Stocks ended modestly lower Thursday as investors struggled to balance hopes for an economic recovery with fears that equities have surged too far, too fast.

The Dow Jones industrial average (INDU) lost 8 points, or 0.1% after ending the previous session at its highest point since last Oct. 6.

The S&P 500 (SPX) index fell about 3 points, or 0.3%, after ending the previous session at its highest point since Oct. 3 of last year. The Nasdaq composite (COMP) lost 6 points, or 0.3%, after closing at its highest point since last Sept. 26.

The three major indexes have ended higher in 8 of the last 10 sessions.

U.S. stocks surged to almost one-year highs Wednesday on continued optimism about the economy. Thursday brought new reports supporting hopes that a recovery is underway, but the response from investors was more muted as worries persist that the stock rally has outpaced the recovery.

By afternoon, investors were ditching some of the biggest gainers from the last few weeks, including financials, commodities and big industrial names.

Big Dow losers included Alcoa (AA, Fortune 500), General Electric (GE, Fortune 500), American Express (AXP, Fortune 500), Travelers (TRV, Fortune 500) and Verizon Communications (VZ, Fortune 500).

Stocks have surged over the last six months as investors have welcomed a rash of improving economic news and an unprecedented amount of fiscal and monetary stimulus. Since bottoming at a 12-year low in March, the Dow industrials have gained just shy of 50% and the S&P 500 has gained 58%, as of Wednesday's close. Since bottoming at a six-year low, the Nasdaq has gained 68%.

However, the continuing gains could be a cause for concern.

"This is a playable market rally within a long-term poor economy and bear market," said Robert Loest, portfolio manager at Integrity Funds. "This is not in my view the beginning of a long-term sustainable bull market."

Trading could be volatile and volume could be higher through the quarterly options expiration Friday. On Friday, stock index futures and options, and individual stock futures and options all expire at the same time.

Economy: The number of Americans filing new claims for unemployment fell last week to 545,000 from a revised 557,000 in the previous week, the Labor Department reported Thursday morning. Economists surveyed by Briefing.com forecast that claims would rise modestly.

Continuing claims, a measure of Americans who have been filing claims for unemployment for a week or more, rose to 6.23 million versus forecasts for a rise to 6.1 million.

A rise in apartment construction helped push August housing starts to the highest point in roughly nine months, the Commerce Department reported Thursday.

Starts rose 1.5% to an annual unit rate of 598,000 from a revised 589,000 in July, the government said. That was in line with economists' forecasts.

Building permits, a measure of builder confidence, rose 2.7% to 579,000 from a revised 564,000 in July.

The Philadelphia Fed index rose to a 27-month high in September, adding to other evidence that the manufacturing sector is recovering. The index, a regional read on manufacturing, rose to 14.1 in September from 4.2 previously. Economists thought it would rise to 8, on average.

Corporate news: FedEx (FDX, Fortune 500) said fiscal first-quarter earnings fell 53% from a year ago, meeting the forecast it issued last week. The package delivery firm reported weaker earnings that met forecasts on lower revenue that was shy of expectations. Shares fell 2.2% Thursday.

Oracle (ORCL, Fortune 500) reported weaker quarterly revenue that missed forecasts late Wednesday. The software maker also reported higher quarterly earnings of 30 cents per share that were in line with forecasts. Shares fell 2.8%.

American Airlines parent AMR (AMR, Fortune 500) said it raised $2.9 billion, including cash and financing. The airline also said it will shift some flights to more profitable hubs such as Chicago and New York and away from St. Louis and other places. Shares rose almost 20%.

Currency and commodities: The dollar hit a fresh 9-month low against the euro and bounced after hitting a 7-month low against the yen.

The falling greenback has been lifting dollar-traded commodities including oil and gold lately, but prices were muted Thursday.

U.S. light crude oil for October delivery fell 4 cents to settle at $72.47 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $6.70 to $1,013.50 an ounce after settling Wednesday at a record high of $1,020.20.

Bonds: Treasury prices gained, lowering the yield on the benchmark 10-year note to 3.40% from 3.46% Wednesday. Treasury prices and yields move in opposite directions.

World markets: Global markets rallied. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all gained. Asian markets surged, with Japan's Nikkei adding 1.7% after the Bank of Japan raised its economic forecast.

Market breadth was mixed. On the New York Stock Exchange, losers topped winners by eight to seven on volume of 1.52 billion shares. On the Nasdaq, advancers and decliners were narrowly mixed on volume of 2.65 billion shares. ![]()