Stocks slip after confidence drops

Improved housing report and weaker consumer confidence index raise more questions about the strength of a recovery on anniversary of the Dow's biggest one-day point loss ever.

NEW YORK (CNNMoney.com) -- Stocks slipped Tuesday after a surprise drop in consumer confidence countered a better-than-expected housing market report. That added to lingering questions about the strength of an economic recovery.

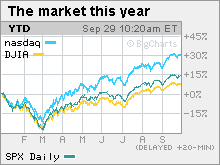

The Dow Jones industrial average (INDU) lost 47 points, or 0.5%. The S&P 500 (SPX) index lost 2 points, or 0.2%. The Nasdaq composite (COMP) lost 2 points, or 0.2%.

Stocks churned in the early going, before turning lower after the 10 a.m. ET release of the consumer confidence report. By afternoon, stocks were volatile, bouncing across the unchanged line.

"Many people believe that you still need to see the consumer come back for the recovery to be sustainable," said Ron Kiddoo, chief investment officer at Cozad Asset Management. "If consumers aren't confident, they're not going to spend."

After sliding last week, stocks bounced back Monday as investors welcomed multi-billion dollar merger news involving Abbott Labs (ABT, Fortune 500) and Xerox (XRX, Fortune 500).

But the advance was short lived, with investors again showing caution after a seven-month rally that has left the leading indexes at nearly one-year highs.

"We continue to wait for the market to slow down," said Scott Armiger, portfolio manager at Christiana Bank & Trust.

Since bottoming at a 12-year low March 9, the S&P 500 has gained just shy of 57% and the Dow has gained around 49%, as of Tuesday's close. After hitting a six-year low, the Nasdaq has gained nearly 68%.

Bets that the economy is slowly starting to recover -- plus the impact of extraordinary amounts of fiscal and monetary stimulus -- have fueled the market advance.

Despite pervasive calls for a September selloff, stocks have held on to gains and moved higher this month.

"You don't know if a September selloff has just been pushed into October or if a big selloff can be avoided altogether," he said.

Economy: Consumer confidence dropped in September, potentially a bad sign ahead of the critical holiday retail sales period. The Conference Board said its consumer confidence index fell to 53.1 from 54.5 in August. Economists surveyed by Briefing.com were expecting the index to rise to 57.

The pace of falling home prices continued to slow, according to a report released before the markets opened. The Case-Shiller 20-city home price index rose 1.6% in July from June, more than triple what economists surveyed by Briefing.com were expecting.

Prices dropped 13.3% in July versus a year ago, a decline that was slower than the drop of 14.2% economists were expecting. Prices fell 15.4% year-over-year in June.

Company news: CIT Group (CIT, Fortune 500), fighting to pay off debt and avoid bankruptcy, is reportedly negotiating a new credit facility that could total $10 billion. Shares of the lender jumped 31%. Earlier, reports said that hedge fund manager John Paulson was considering merging CIT with failed mortgage lender IndyMac.

Dell unveiled its newest high-end, super-thin personal computer late Monday. Called the Latitude Z, the 4.5-pound PC will retail for $1,999. Dell (DELL, Fortune 500) shares fell 3% Tuesday.

JPMorgan Chase (JPM, Fortune 500) said it is shuffling some of the management responsibilities of its successful investment banking and asset management units. Shares were little changed.

Drugstore chain Walgreen (WAG, Fortune 500) reported weaker quarterly earnings and higher quarterly revenue, both of which topped analysts' estimates. Shares rose 9%.

Sequenom (SQNM)'s board said it has removed most of its management team, including the CEO, following a scandal involving mishandling of research and results on its prenatal Down syndrome test. Shares of the genetic analysis product developer fell 39% in unusually active NYSE trading.

Market breadth was negative. On the New York Stock Exchange, losers narrowly edged winners on volume of 1.18 billion shares. On the Nasdaq, decliners topped advancers by five to four on volume of 2.11 billion shares.

One-year later: Tuesday is the first anniversary of the Dow's biggest one-day point loss of all time, when the average plummeted 777.68 points and the broad market knocked out $1.2 trillion in value.

The plunge followed the House of Representatives's decision to reject the government's then $700 billion bank bailout plan. With banks around the globe teetering on the brink of collapse and credit nearly frozen, the decision sparked a panic that battered stocks in every sector.

The crash followed a brutal two-week roller-coaster, triggered by the near-meltdown of Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500) and the collapse of Lehman Brothers.

World markets: Global markets were mixed. In Europe, London's FTSE 100 and France's CAC 40 were little changed, while Germany's DAX slipped. Asian markets rallied, with the Japanese Nikkei rising 0.9%.

Currency and commodities: The dollar rose versus the yen and euro, pushing higher after repeatedly hitting one-year lows against a basket of currencies over the last few weeks.

U.S. light crude oil for October delivery fell 13 cents to settle at $66.71 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery rose 30 cents to settle at $994.40 an ounce. Gold closed at a record high of $1,020.20 two weeks ago.

Bonds: Treasury prices slumped, raising the yield on the benchmark 10-year note to 3.29% from 3.28% late Monday. Treasury prices and yields move in opposite directions. ![]()

Microsoft stages a big comeback

G-20 summit: 6 countries in recovery

Fed: Economic activity has 'picked up'

Fighting off the Bear: Seven stories

5 lessons from the crash

50 Most Powerful Women

Bernanke: Fed's unlikely risk taker

100 Fastest-growing companies

50 years of profit swings