Stocks lose steam

Dow pared gains, ending slightly higher with other indexes lower. Trading stayed in a tight range on investor caution after previous day's rally.

NEW YORK (CNNMoney.com) -- Stocks ended mixed Tuesday, giving up some gains, as the market faltered after a triple-digit rally in the previous session.

The pullback after a day of choppy trade showed investors were cautious after a Monday jump that pushed the blue-chip Dow to its highest level in 13 months.

After reversing several times, the Dow Jones industrial average (INDU) closed up 20 points, or 0.2%, to close at 10,246.97.

The S&P 500 (SPX) slipped less than 1 point, or less than 0.1%, to end at 1,093.01, and the Nasdaq composite (COMP) fell 3 points, or 0.1%, to settle at 2,151.08.

David Babbs, head of trading at MF Global in London, said the lack of news this week means the market is "going to go sideways and wait for its next cue."

The market will likely remain in a tight band until the next Federal Reserve policy-setting meeting Dec. 16, said Don Humphreys, president of Voyager Wealth Management.

"After a rally like Monday's, there's always a chance for a pullback, but I think we'll tread water," Humphreys said. "Overall, the trend continues to be higher."

Tuesday could not sustain momentum from the rally Monday, which came after the Group of 20 said over the weekend that it would keep economic stimulus in place.

"We see that stimulus is still needed," said Peter Cardillo, chief market economist at Avalon Partners. "And as long as money is cheap, people will continue to invest."

A falling dollar boosted prices for gold, oil and other commodities, and Cardillo said investors will focus on those markets in absence of major reports -- as well as corporate news including earnings from Applied Materials (AMAT, Fortune 500), Wal-Mart (WMT, Fortune 500) and Walt Disney (DIS, Fortune 500).

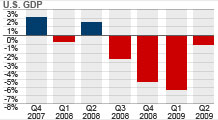

Long-term focus. The Dow has soared 56% after hitting a 12-year low in March, and the blue-chip index is up 16.5% for all of 2009. The Nasdaq has jumped 36.6% this year.

Monday's rally was the Dow's third gain of more than 199 points in the past eight trading days. But despite roaring back from its March nadir the Dow is still 28% below the record high set in October 2007.

Analysts and investors alike have struggled to determine whether the recent rally is justified. Voyager Wealth's Humphreys says it depends on the timeline.

"Maybe the fundamentals aren't there for a quick kill, but that's a short-term basis," Humphreys said. "I think for longer-term investors, the fundamentals are there -- we are out of the worst of this recession."

Barring a change in federal interest rate policy, Humphreys said he expects a "flat to higher trend" in the market for the remainder of 2009 with the Dow ending the year above 10,000.

Economy: Most U.S. cities saw gains in the median price of single-family homes sold last quarter, said a report from the National Association of Realtors. The national median home price was $177,900 in the third quarter, up $7,000 from the previous quarter.

In other housing news, the Treasury Department said 650,000 troubled borrowers have been put into trial loan modifications under the Obama administration's foreclosure rescue plan.

Companies: Sprint Nextel (S, Fortune 500) said Monday that it plans to cut between 2,000 and 2,500 jobs in an attempt to reduce costs.

The European Commission has objected to Oracle's (ORCL, Fortune 500) proposed takeover of Sun Microsystems (JAVA, Fortune 500), which could threaten the deal.

Other markets: Global markets were mixed. Asian shares finished the session in positive territory, and European stocks ended slightly lower.

The dollar rose off 15-month lows, jumping slightly against the euro and the British pound. The greenback inched up on the Japanese yen.

The price of U.S. crude oil fell 38 cents to settle at $79.05 a barrel.

Treasurys were steady Tuesday, after a record $25 billion offering of 10-year notes attracted strong demand. The 10-year yield fell to 3.47% from 3.48% late Monday.

The government is selling $81 billion worth of debt this week in a quarterly refunding. Treasury will auction $16 billion in 30-year bonds later in the week.

Market breadth was negative. On the New York Stock Exchange, losers topped winners by three to two on volume of 900 million shares. On the Nasdaq, decliners topped advancers almost nine to four on volume of 1.9 billion shares. ![]()