Search News

NEW YORK (CNNMoney.com) -- A Madoff in-law has filed for a name change, hoping to rid herself of the notorious moniker that has become synonymous with swindle.

Stephanie Madoff, daughter-in-law of the imprisoned Bernard Madoff, filed for a name change with the New York Supreme Court in Manhattan, citing death threats against her family.

|

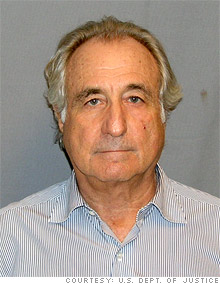

| The daughter-in-law of Bernard Madoff, shown here in his mug shot, is changing her last name to Morgan. |

Stephanie, who is married to Bernard's son Mark, is seeking to change the surname of herself and her two young children to Morgan. In court documents, she said she "wishes to avoid additional embarrassment, harassment and endangerment associated with the name 'Madoff.'"

Stephanie's infant daughter and son - the grandchildren of Bernard - will retain Madoff as a middle name, but their last name will be changed to Morgan, according to the documents.

The documents did not say why she chose this particular name. The documents also said that the father, Mark, does not object to the change.

Mark has not been charged with a crime, nor have any other family members, in connection with the swindle. Stephanie's lawyer Nancy Chemtob declined to comment.

Meanwhile, Stephanie's father-in-law is only weeks away from his prison anniversary for perpetrating a long-running Ponzi scheme, in which he stole billions of dollars from thousands of victims. His fraud was so sweeping that it eclipsed even the early 20th-century scam by Charles Ponzi, who gave this pyramid-style scheme its name.

On March 12, 2009, Bernard Madoff pleaded guilty to 11 federal counts, including money laundering, perjury, false filing with the Securities and Exchange Commission, and other crimes.

Madoff masqueraded his investment firm as legitimate when it was nothing more than a front. He would use the funds from new investors to send payments to his more mature investors. He would falsely portray these payments as proceeds from investments, when they were actually stolen money.

He was sentenced to 150 years in prison by a judge who lambasted him for his "extraordinarily evil" crimes. After a temporary incarceration in Manhattan, he was transferred to Butner Federal Correction Complex, a medium-security prison in North Carolina, where he still resides.

Madoff, 71, faces a release date of Nov. 14, 2139.

He may soon get company. His former accountant, David Friehling, faces sentencing on Friday in U.S. District Court, Southern District, in Manhattan. He could face up to 114 years in prison for cooking the books for the Ponzi kingpin.

Friehling pleaded guilty in November to nine counts that included securities fraud, investment advisor fraud, false filing with the SEC and tax law violations.

Another alleged accomplice was arrested on Thursday. The U.S. Attorney's office in the Southern District of New York said that Daniel Bonventre, former operations director for Madoff's firm, was charged with conspiracy, falsifying company records and securities and tax fraud.

He had been working at the firm from 1968 to its final days in 2008, and could face up to 77 years. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |