Search News

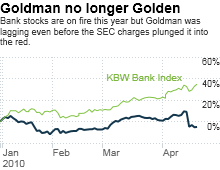

NEW YORK (CNNMoney.com) -- Investors that like to go against the grain often think that the best time to buy a stock is when nobody likes it. Well, it's tough to find a company that's despised more than Goldman Sachs these days.

Forget about Chris Rock and his canceled-way-too-soon sitcom. Everybody hates Lloyd. As in Goldman Sachs CEO Blankfein.

So if you're really a contrarian type of investor, is now the time to actually make a big bet on Goldman (GS, Fortune 500)?

Of course, there is a risk in buying this stock now that can be summed up in three letters: S-E-C. The fraud charges are obviously a significant overhang on the company right now -- and probably deservedly so.

Goldman's shares plummeted 13% Friday after the federal agency accused the Wall Street titan of creating a mortgage security that it knew would tank and allowing one of the investors betting against it to pick the soured assets to go into the security.

In a note to clients, Barry Ritholtz, the CEO of research firm Fusion IQ, described this Friday as Wall Street's version of Mel Brooks' "The Producers," -- i.e. a devious scheme to profit from failure. (Of course, their plan backfired in the popular movie and Broadway show.)

"What Goldman allegedly did is a material misrepresentation to investors," Ritholtz said in an interview. "I wouldn't be surprised to see this as a cloud that will keep Goldman stock in a narrow range for a long period of time."

But some Goldman Sachs investors are sticking with the company -- fraud charges be damned.

Bob Bacarella, manager of the Monetta Fund in Wheaton, Ill, said he added to his fund's position on Goldman after the stock dropped and would buy even more if the price goes lower.

Bacarella thinks that Goldman will ultimately be found to not have violated any SEC regulations and that even if it isn't, the worst case scenario is likely a fine that will not exactly break the bank.

"This is an overreaction. It's a wonderful buying opportunity," he said.

Goldman bulls also point to the investment bank's strong first quarter earnings report as a reason to buy. Goldman reported a much bigger than expected profit of $3.5 billion on Tuesday. Despite that, Goldman's stock has been little changed since last Friday.

"Clearly the entire financial sector is in the regulatory headlights, but we still regard Goldman as the dominant player on Wall Street," said Brad Thompson, managing director with Frost Investment Advisors in San Antonio.

The firm owns Goldman in its Frost Core Growth Equity fund. Thompson said the fund has neither bought nor sold any of its Goldman stake since Friday's news. But he said there's a strong case to be made for the stock being undervalued.

He pointed to Goldman's book value, or assets minus liabilities. Goldman reported book value of $122 and change a share in its first quarter earnings report. The stock currently trades at about $160 a share, or 1.3 times book value.

But Thompson said because of Goldman's market leadership position, it deserves to trade at a value closer to 1.7 times book value. That would translate to a stock price of more than $205 a share, or nearly 30% above current levels.

Another fund manager said that he thought investors were focusing too much on regulatory concerns for most of the big banks, particularly JPMorgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500), and ignoring strong earnings as a result.

"The larger banks are mispriced," said Stephen Gutch, portfolio manager at Federated Clover Investment Advisors in Rochester, N.Y. "The earnings were much better than what people were expecting."

Gutch said he could not comment on Goldman Sachs specifically. But according to the firm's most recently available data about its holdings, the Federated Clover Value fund owned a stake in Goldman Sachs as well as Chase and BofA as of the end of 2009.

Of course, accusations of fraud are not to be taken lightly. The headlines about Goldman are so relentlessly negative, it might make sense to sit tight before buying Goldman. The stock may be a good long-term buy but it could get significantly cheaper in the short term.

Eric Marshall, a fund manager with Hodges Capital Management in Dallas, said his firm sold Goldman late last year and that the stock needs to fall further before he'd reconsider buying again.

"When stocks fall out of favor, the pendulum usually swings to an extreme. So there's no hurry to go out and buy Goldman just yet. We'd wait for the dust to settle a little more," he said.

Investors have also been burned in the past by the likes of Enron, Tyco and WorldCom, to name a few. Yet as I pointed out Monday, Goldman's alleged sins don't appear to come close to the level of Enron's accounting fraud.

That's not to say Goldman should get off scot-free if it did in fact violate SEC rules. I hope the SEC continues to investigate Goldman and the rest of Wall Street for signs of any other shady subprime mortgage deals.

But it's probably a mistake to think that Goldman will be punished so severely that it would cause irreparable damage to the firm's reputation or future earnings prospects. Ritholtz conceded as such. He cynically pointed out that this is hardly the first example of an overzealous salesman or trader running amok.

"The bottom line is Goldman Sachs is a money printing machine and has been for a long time. Unless this case puts a major strain on their reputation, any civil liabilities are almost a cost of doing business," he said.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |