Search News

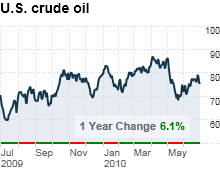

NEW YORK (CNNMoney.com) -- Oil prices continued to slide Wednesday, and posted the first quarterly decline since the fourth quarter of 2008, after a weaker-than-expected report on crude inventories.

What prices are doing: Crude oil futures for August delivery fell 31 cents, or 0.4%, to settle at $75.63 a barrel.

Over the course of the quarter, oil prices lost 9.7%. Prices have gained every quarter since the last quarter of 2008, when they plunged by 55.7%.

The national average price for a gallon of regular unleaded gas held steady at $2.755, unchanged from the previous day's price, according to motorist group AAA.

What's moving the market: Investors were disappointed by weekly supply report that showed weak demand for crude oil. The Energy Information Administration said that gasoline stockpiles jumped by 500,000 barrels, surprising analysts who expected them to drop by 400,000 barrels, according to a consensus estimate collected by energy information provider Platts.

Distillates, used to make heating oil and diesel, increased by 2.5 million barrels, above the 1.3 million-barrel increase analysts had forecast.

Crude inventories fell by 2 million barrels last week. Analysts expected crude supplies to fall by 1.2 million barrels.

Oil prices were also pressured by a report from Automatic Data Processing showed that employers added 13,000 jobs in June, but the gain was below forecasts.

Economists surveyed by Briefing.com expected payrolls to climb by 61,000 during the month.

What analysts are saying: "The main focus for the energy market will switch to the weekly EIA oil inventories report," said Myrto Sokou, analyst at Sucden Financial, in a research note.

"Crude oil prices have retreated almost 10% from the end of March, displaying fears for the pace of the economic recovery," Sokou said. "However, the U.S. hurricane season could provide some support to the energy market and hold crude oil prices in the $70-$80 per barrel range in the near term." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |