Search News

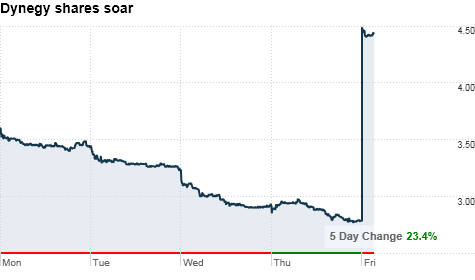

NEW YORK (CNNMoney.com) -- Shares of Dynegy Inc. - a power generating company that played a role in the Enron scandal - surged more than 60% Friday after the company agreed to be acquired by investment firm Blackstone Group for $4.7 billion, including its existing debt.

Under the deal with Blackstone Group (BX), Dynegy stockholders will receive $4.50 in cash for each share of Dynegy common stock they own -- a 62% premium to the closing share price of $2.78 on Thursday, the company said.

Shares of Houston-based Dynegy (DYN) soared about 61% to $4.47 after the opening bell.

The deal also includes an agreement between Blackstone and power generator NRG Energy (NRG, Fortune 500), under which NRG will acquire four of Dynegy's natural gas-fueled plants in Maine and California for about $1.36 billion.

Dynegy, whose shares have fallen 89% over the past three years, has 40 days to shop around for competing offers.

In late 2001, Dynegy considered a $9 billion merger with Enron Corp. to bailout the disgraced energy giant. But Dynegy pulled the plug on the deal after having difficulty getting a true appraisal of Enron's worth, and soon after Enron went bankrupt.

A former Dynegy executive, Jamie Olis, served 5 years in prison for a bookkeeping scandal involving the company. He was released a year ago, according to the Federal Bureau of Prisons. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |