Search News

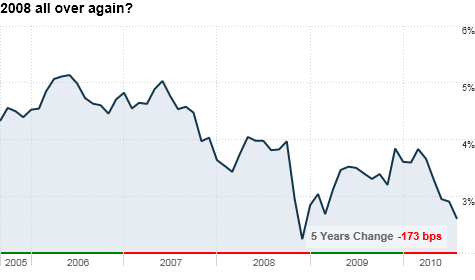

The 10-Year Treasury yield has taken a steep tumble this year and some believe rates could fall below the levels they hit during the peak of the 2008 financial crisis.

The 10-Year Treasury yield has taken a steep tumble this year and some believe rates could fall below the levels they hit during the peak of the 2008 financial crisis.

NEW YORK (CNNMoney.com) -- The global economy is clearly cooling. But is this just a minor hiccup on the path to a sustained recovery or a slide back to the dark days of 2008 and early 2009?

Unfortunately, bond investors appear to be betting on the latter. The yield on the benchmark 10-year Treasury note fell to about 2.57% early Monday afternoon. That's the lowest level since March 2009.

Falling rates are often a sign of a weak economy. Earlier this year, when many experts thought that the worst was truly over in the United States and that a fairly healthy rebound was possible, the yield on the 10-year traded as high as 4.01%.

"A lot of people thought rates would be much higher than they are right now. Clearly, the recovery is much weaker than people anticipated," said Mario De Rose, fixed income strategist with Edward Jones in St. Louis. "It could be a year or two before rates go much higher than here and that's what disconcerting."

The swift drop in long-term rates is undoubtedly a cause for concern. It may remind some investors of the scary economic conditions immediately following the collapse of Lehman Brothers nearly two years ago. The 10-year yield eventually fell to a low of 2.04% in late December 2008.

It's troubling that the yield is now only about a little more than a half-percentage point above that level. But some experts think that the recent bond spike (prices and yields move in opposite direction) is overdone and may soon reverse course.

"The rally is mostly unjustified The move has been so swift and so severe," said Guy LeBas, chief fixed income strategist with Janney Montgomery Scott in Philadelphia. "To be honest, I expect a slow creep higher in interest rates."

LeBas said that the 10-year yield may fall as low as 2.5%, but he doubts it will go below that. His reasoning? He said that deflation fears may be overdone and that once the market realizes that there is a difference between low inflation and deflation, yields should move higher again as people sell bonds and move back to riskier assets like stocks.

However, others think that a return to the lows of December 2008 is not out of the question -- even if investors aren't fearing a deflationary death spiral.

Brian Battle, director with Performance Trust Capital Partners, a fixed-income trading firm in Chicago, said there is one simple reason why bond yields could fall a lot lower. The Federal Reserve.

Last week, the Fed indicated that it was ready to start up its so-called quantitative easing program, a move some have derisively dubbed QE2 or QE Lite. Basically, the central bank is going to begin buying more long-term Treasury bonds such as the 10-year and 30-year, in order to keep rates low.

This, the Fed hopes, will keep long-term rates low enough to prevent the economy from falling back into recession, the feared double-dip. But Battle said that what the Fed is really doing is giving bond investors no reason to sell.

Along those lines, this is actually a trend in all parts of the Treasury market. Steve Van Order, chief fixed income strategist with Calvert Funds in Bethesda, Maryland, pointed out that on the shorter-end of the yield curve, the 2-year Treasury has already dipped below its crisis levels and is now at an all-time low.

Van Order said that it would not surprise him if the 10-year eventually follows suit and hits a new low. He said that as long as economic data continues to show that the recovery is at best, weak, then there's no reason for investors to fight the Fed.

The good news though is that Van Order does not believe lower rates are a sign of fear as they were in December 2008.

"This isn't a panic. This is more of a considered evaluation of the economic situation and people following the lead of the central bank," Van Order said.

Battle agreed. He said it is "100% reasonable" to suggest that rates could fall as low as they were in December 2008, but that it's not because of an Armageddon trade where people are dumping everything but Treasurys.

"The government gorilla is back in the bond market. Their goal is to lower rates. They don't care about price. You don't stand in front of a steamroller the size of the Fed," said Battle.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |