Search News

Click chart to view other commodities.

Click chart to view other commodities.

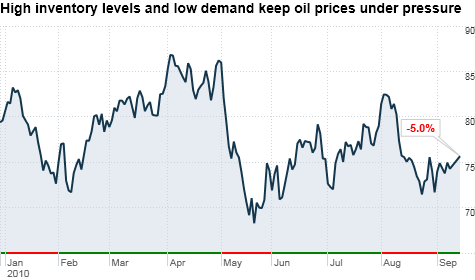

NEW YORK (CNNMoney.com) -- As the U.S. dollar gains strength and crude inventories remain high amid low demand, oil prices are coming under pressure.

Prices are down slightly this week, sinking 1% Wednesday after the Japanese government announced it would sell yen and buy U.S. dollars in an attempt to rein in its rising currency.

The nation's move to intervene in the currency markets pushed the greenback up more than 3% versus the yen early Wednesday, sending oil -- which is priced in U.S. dollars -- sharply lower.

Supply glut?: Meanwhile, traders continued to worry about a glut in inventories.

A report late Tuesday from the American Petroleum Institute showed an unexpected build in crude supplies last week, while the more closely-watched inventory report from the Energy Information Administration showed that supplies fell.

The EIA said crude inventories, which remain "above the upper limit of the average range for this time of year," fell 2.5 million barrels last week, slightly more than the 2.25 million-barrel drop that analysts had forecast.

Despite a weekly dip in supplies, oil inventories are hovering at the highest levels since the 1990s, said James Williams, president of WTRG Economics.

"Our inventories across the board are very strong, and in addition to that, this is one of the two low demand seasons of the year -- when driving season is over and the heating season hasn't started," said Williams. "So the overall fundamentals point to lower prices."

Pipeline replacement: Expectations that a 670,000 barrel-a-day pipeline, shut over the weekend by Enbridge Inc., would soon resume normal service also pressured prices.

The pipe runs from Wisconsin to Indiana and is one of three pipelines owned by Enbridge that has been closed this summer due to leaks. The closures have caused gasoline prices to spike throughout the Midwest.

"It doesn't look like it's going to be long before they have this one back up," said Williams. "After taking into consideration the oil diverted through other pipelines around it, we're talking about a net loss of about a quarter of a million barrels a day, so that being replaced is helping prices move lower."

Economic jitters: On top of high supply levels and a stronger dollar, concerns about the global economic recovery haven't gone away. As economic reports about the U.S. economy and abroad continue to send mixed signals, oil will likely hover in a range of $70 to $80 for the rest of the month.

"Crude oil moves with the stock market, and you have a market that has a lot of uncertainty in it," said Williams. "One day it's 'Oh, everything's going to be better," and the next day you read about housing sales or something else and you think, "Oh no, this will never stop.'"

"Clearly we're in anything but what you would call a solid recovery, and the biggest threat to oil prices is a double-dip recession," he added. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |