Search News

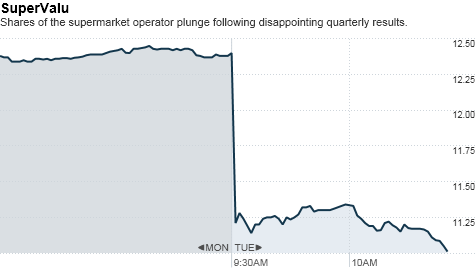

NEW YORK (CNNMoney.com) -- SuperValu shares lost value Tuesday, after the supermarket operator posted a steep loss in the second quarter.

The company logged a second-quarter loss of $1.47 billion, or $6.94 a share; compared with a profit of $74 million, or 35 cents a share, a year ago. SuperValu operates grocery store chains including Shop 'n Save and Albertsons.

Excluding charges stemming from a labor dispute at Shaw's Supermarkets and employee-related costs, earnings in the second quarter came in at $59 million, or 28 cents a share. But that still missed analysts' expectations of 29 cents a share.

On top of missing expectations in the quarter, SuperValu (SVU, Fortune 500) lowered its outlook for the year to a range of $1.40 a share to $1.60 a share -- it initially offered guidance of $1.75 a share to $1.95 a share.

"Our sales performance continues to reflect a difficult operating environment," said SuperValu CEO Craig Herkert in a prepared statement.

"It will take longer than originally anticipated to realize the benefit of the marketing, merchandising and operational initiatives that we continue to build upon," he added.

SuperValu stock slid more than 12% on the news, making it the biggest loser on the S&P 500 Index in mid-morning trading. Shares of the company dropped to $10.84 a share, from Monday's closing price of $12.40. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |