Click chart for more commodities data.

Click chart for more commodities data.

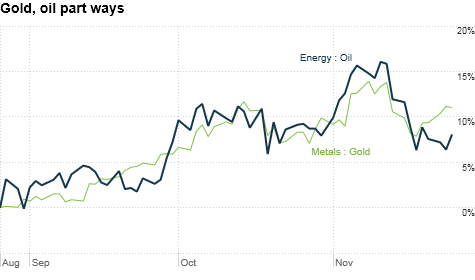

NEW YORK (CNNMoney.com) -- Gold and oil prices have been joined at the hip in recent months, but that all changed in the days leading up to Thanksgiving.

Gold prices are back on the rise, rebounding from a brief decline as investors seek refuge from eurozone debt worries and the prospect of a bigger clash on the Korean Peninsula.

Other commodities have diverged. Crude prices, which earlier this month hit two-year highs near $88 a barrel, spent the week hovering within a narrow trading range just above $80. That marks the first time since late August that gold and oil prices have parted ways.

Commodities had been on a roll since the Fed outlined its asset purchasing program earlier this month. The purchases will put pressure on the U.S. dollar. Since commodities are priced in dollars around the world, a lower greenback makes it cheaper for foreign investors to buy.

But rising geopolitical worries have cooled investor enthusiasm.

"It seems the world has gone crazy and there are new risks around every corner and these risks have conspired to bring oil prices back down," said Phil Flynn, an analyst with PFG Best, in a note to clients.

Eurozone debt worries, the release of the Fed's lower outlook and conflict in Korea have all contributed to the cooldown, Flynn said.

Oil did get a boost Wednesday, following the government's weekly inventory report. The report showed crude inventors bumped higher in the latest week. According to research firm Platts, inventories were expected to decline. Crude prices for January delivery rose $2.61, or 3.2%, to settle at $83.86 a barrel -- it's highest close in over a week.

And in a bit of good news for consumers heading into the holiday shopping season, cotton futures have been on the decline. Over the past 10 days, cotton prices have dropped some 15%.

Cotton prices had been on a tear for months, and that was worrisome for consumers because higher cotton prices translates into higher prices for jeans, t-shirts and other clothing.

Prices for other metals moved higher Wednesday, with copper gaining 1.5%. Among agricultural commodities, corn, soy beans and wheat gained around 1%.

Coffee and lumber prices were the lone decliners on the commodities board, with both trading about 1% lower. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |