Search News

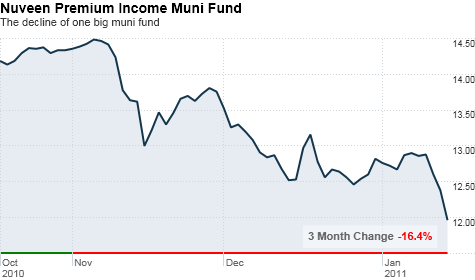

NEW YORK (CNNMoney) -- Municipal bonds continued to sell off this week, as worried investors fled the market, and the media continued to churn out stories about state and local governments struggling with severe budget shortfalls.

It's easy enough to understand the concern. A growing number of states, including some of the biggest -- like California and Illinois -- face budget shortfalls of billions of dollars.

And that's led to growing concern that those states, as well as smaller counties and cities, might default on their municipal bonds if politicians don't start making some hard choices about how to raise revenue.

Add in prominent bank analyst Meredith Whitney's doomsday prediction of up to 100 sizable defaults in the muni bond market -- broadcast to the nation during a recent 60 Minutes interview -- and you have the makings of a full scale sell-off in the muni bond market.

The speculation has helped send yields on 30-year AAA-rated muni bonds to near 5%, levels not seen since early 2009.

It's a convincing narrative, but one that has left experts within the field scratching their heads at the public's reaction.

"We have been inundated with phone calls from clients inquiring about this situation, said Burt Mulford, a municipal portfolio manager at Eagle Asset Management. "My belief is the attention-grabbing, doomsday headlines are overplaying the picture."

Small-time retail investors play an outsized role in the market, accounting for roughly two-thirds of transactions. According to Mulford, that means trouble, because muni bonds are one of the least transparent markets to invest in.

"There is not very much transparency in this market, and that's the problem," Mulford said. "Investors can't go to the Wall Street Journal or CNNMoney and get a quote on an individual bond."

But they can watch 60 Minutes -- and read media stories about budget shortfalls.

"Investors are nervous about putting money to work when they see Meredith Whitney on 60 Minutes," Mulford said.

But many say fears are overblown. The details about why are imbedded in the unique nature of the muni bond market.

Thousands of muni bonds are available for purchase, and the market is highly segmented, with all kinds of debt being issued by all types of governments.

For instance -- Harrisburg, Pa., attracted a lot of attention after an incinerator project drove the city deep into debt. But Mulford said that's the exception, rather than the rule.

"You are rarely going to see a local government default, and if you look at states, there has never been a default for a state, and if there is a default, the recovery rates are very high -- almost 90%."

That means that even in the case of a default, bond holders recoup almost all of the money they are owed, which is not the case in riskier corporate bonds.

Sticking with bonds issued by municipalities that are on sounds footing will mitigate risks, Mulford said.

"You really have to know what you are buying," he said. "We generally stay away from the more speculative sectors, where revenue streams are harder to predict."

It remains unclear exactly how much of the bond sell-off can be attributed to worries of large-scale defaults, but it's certainly a factor.

The drop in recent weeks is due "almost 100%" to fears of large-scale defaults stoked by the media, said John Mousseau, managing director and portfolio manager at Cumberland Advisors.

The stage was set last year, when the muni market was hit by a wave of supply.

The second round of quantitative easing by the Fed, and uncertainty over the extension of the Build America Bonds program both encouraged issuers to flood the market.

"As a result, they clobbered the market and doubled the supply," Mousseau said. That set the stage for declining prices, as demand was unable to keep pace.

The decline in prices has Mousseau grabbing muni bonds.

"We don't know how long this opportunity will last, but we are buying," he said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |