Search News

Click chart to track bonds and rates.

Click chart to track bonds and rates.

NEW YORK (CNNMoney) -- Treasuries are on a wild roller coaster ride to nowhere.

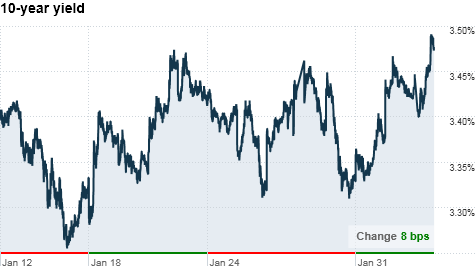

Volatile day-to-day moves have kept bond traders busy for more than a month, but overall, the yield on the benchmark 10-year note has barely budged.

The 10-year yield has stayed in a range between 3.25% and 3.5% for more than three weeks now. That matters not just to institutional investors but to average folks too, because the yield on the 10-year note helps set long-term interest rates on everything from savings accounts to mortgages.

Here's what's keeping traders on their toes.

Turmoil in Egypt: Investors are closely watching the uprisings in Egypt and elsewhere in the Middle East, since political instability abroad increases the appeal of U.S. government debt as a safe investment.

So when the riots in Egypt erupted last week, bond prices went up, and yields -- which move in the opposite direction -- fell.

But the turmoil in Egypt also raises worries that oil prices will rise rapidly going forward, which could lead bond prices to fall.

That's because traders fear higher energy prices can cause inflation to take off quickly, making the current low yields on bonds much less attractive an investment vs. stocks.

"With interest rates this low, people have been making the bet that their money is better off elsewhere," said Richard Bryant, head of Treasury trading at MF Global."We've seen flows out of bond funds and into stock funds recently."

Economic reports: Also driving volatility is that investors are teetering between focusing on the generally upbeat economic reports that have come out this month and jobs numbers, which were disappointing in December. The next jobs market report is due Friday.

A weak labor market is enough to endanger the entire recovery, and keep investors buying bonds.

"Even if you get some of these other data points coming in better than expected, the real one that counts is unemployment," Bryant said.

Government buying: Bond traders are closely watching the Federal Reserve's bond buys day-to-day, because they affect supply and, thus, prices.

When the Fed buys a lot of 10-year notes, for example, that drives prices on those bonds higher.

The Fed is currently buying $600 billion in Treasuries of varying lengths, through a controversial policy called quantitative easing meant to stimulate the economy.

Under a second program, often called "quantitative easing lite," the Fed reinvests money earned on its maturing mortgage holdings into more Treasuries.

Government selling: Traders are now looking ahead to a $72 billion quarterly re-funding announced by the Treasury Department on Wednesday, which serves to pay for the growing national deficit.

The auctions, held next week, will re-fund $21.8 billion in old bonds that are maturing, and raise an additional $50.2 billion for the government.

What yields are doing: On Wednesday, the 30-year yield climbed to 4.62%, the 2-year yield rose to 0.67%, and the 5-year yield nudged up to 2.09%.

The 10-year note closed at 3.48%, near its highs for the month. Its yield has not closed above 3.5% since Dec. 15.

"A lot of people are wondering, what will break us out of this range," Bryant said. "It's tough to say. At the end of the day, it continues to come down to the strength of the recovery in the U.S. and our ability to create jobs." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |