Click the chart for more market data.

Click the chart for more market data.

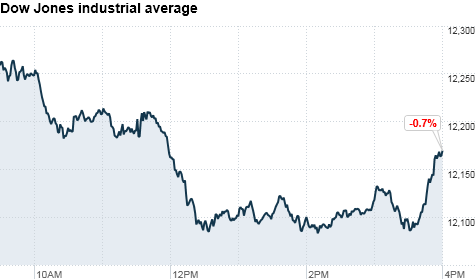

NEW YORK�(CNNMoney) -- U.S. markets fell sharply Friday as oil prices jumped to more than $104 a barrel. Still, stocks managed to eke out gains for the week.

The Dow Jones industrial average (INDU) dropped 88 points, or 0.7%, to 12,170. The Dow had lost as much as 170 points earlier in the session.

The S&P 500 (SPX) slid 9.8 points, or 0.7%, to 1,321.20; and the Nasdaq Composite (COMP) lost 14 points, or 0.5%, to 2,785.

All three indexes closed higher for the week, with the Dow rising 0.3%, and the S&P and Nasdaq rising 0.1% each.

Quickly rising energy costs were the dominant force on traders' minds once again Friday. Crude oil prices jumped $2.90 a barrel, or 2.9%, hitting $104.81 on reports of continuing unrest in Libya and news of protests planned in Saudi Arabia. Gas prices continued to rise, adding 4.4 cents to the AAA national average of $3.35 a gallon.

Traders said that as long as oil remains at elevated levels and Middle East unrest remains unresolved, stock performance will continue to closely track the price of oil.

"Oil above $100 a barrel will remain a persistent headwind to the equity markets, but the bigger question is how long does oil remain at these levels," said Michael James, senior equity trader with Wedbush Morgan Securities.

With oil front and center, Wall Street dismissed the Labor Department's report that the economy added 192,000 jobs in February -- which was in line with expectations. The unemployment rate ticked down slightly to 8.9%.

Investors said Thursday's rally was mostly in anticipation of the jobs report. However the mostly positive report was cast aside once oil prices began rapidly rising during the session.

"Thursday's (rally) was in hopes of a return to job growth, and -- you know what -- we got it and that's great," said Jeff Kleintop, chief market strategist for LPL Financial. "But now we're concerned if this job growth is sustainable with these high oil prices."

Economy: The Commerce Department said factory orders rose 3.1% in January, the biggest gain since September 2006. Economists were looking for factory orders to rise 2%.

Companies: Wal-Mart (WMT, Fortune 500) shares rose 0.1% after the retail giant raising its annual dividend to $1.46 per share.

World markets: European stocks closed lower as oil prices rose. Britain's FTSE 100 lost 0.2%, the DAX in Germany dipped 0.7% and France's CAC 40 fell 1%.

Asian markets ended sharply higher. The Shanghai Composite rallied 1.4%, the Hang Seng in Hong Kong jumped 1.2% and Japan's Nikkei gained 1%.

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but was flat against the British pound.

Gold futures for April delivery rose $12.20 to $1,428.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.55% from 3.52% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |