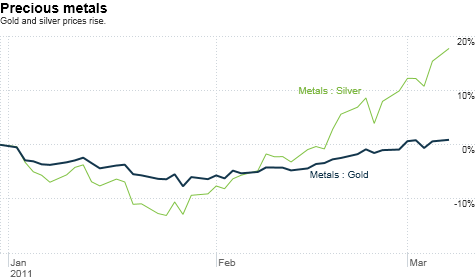

Click chart for more on gold, silver and other commodities

Click chart for more on gold, silver and other commodities

NEW YORK (CNNMoney) -- Gold prices rose to a record high Monday as the political turmoil in Libya boosted demand for tangible "safe-haven" assets such as precious metals.

April gold futures closed at a record high, rising $5.90, or 0.4%, to $1,434.50 an ounce. Earlier in the session, gold prices hit an intraday record high of $1,445.70 an ounce.

"Gold prices have made new all-time highs...as investors flock toward the safe haven against geopolitical and inflationary fears," said Janney Montgomery Scott analyst Dan Wantrobski in a report.

In Libya, fighting between rebels and forces loyal to Libyan leader Moammar Gadhafi continued to exact heavy tolls Monday, with an estimated 1,000 to 2,000 deaths so far.

The strife in Libya follows relatively non-violent uprisings in Tunisia and Egypt earlier this year. Other countries in the region have also been shaken by protests, including Yemen, Oman and Bahrain.

The unrest has pushed oil prices sharply higher in recent weeks as investors worry that supplies could be disrupted from crude exporting nations. Gold prices often rise when the global political and economic outlook turns cloudy, since precious metals are seen as safer bets than stocks or bonds in times of uncertainty.

In addition to geopolitical concerns, gold has been supported by worries about rising inflation.

Gold is seen as a hedge against inflation because the metal tends to hold its value when consumer and wholesale prices rise.

With inflation rates already spiking in some developing economies, some investors worry that the combination of low interest rates in the U.S. and the Fed's quantitative easing plan will cause inflation to spike.

Silver prices were also stronger Monday, rising 75 cents to $36.07 an ounce. That's up over 17% from the start of the year. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |