Search News

Click the chart for more market data.

Click the chart for more market data.

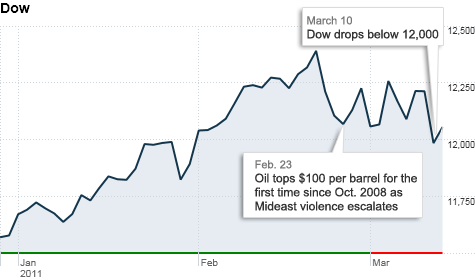

NEW YORK (CNNMoney) -- The stock market is facing plenty of risk, including uncertainty caused by the disaster in Japan. But one threat trumps them all: Oil prices are still sitting over $100 a barrel and could rise higher amid ongoing political turmoil in the Middle East.

While the concern over soaring oil prices has put investors on edge and triggered some sharp losses on Wall Street, the major indexes are still up for the year and near the highest levels since June 2008.

The Dow and S&P 500 have climbed about 4% so far in 2011, and the Nasdaq is up more than 2%.

"Given that there are a host of hurdles that have cropped up in recent weeks, I think the fact that stocks are not far off from recent highs is a sign that the financial markets are extremely resilient right now," said Michael Sheldon, chief market strategist at RDM Financial Group.

While stocks finished in negative territory last week, they posted decent gains during Friday's session, as oil prices dropped 2% in the wake of the massive earthquake and tsunami in Japan, the world's third-largest consumer of crude oil behind the United States and China.

Sheldon remains upbeat on the market's outlook, but he said trading could remain choppy as investors keep a close eye on news coming out of the Middle East. Of particular concern would be a disruption in oil production, which can lead oil prices higher.

"Rising energy prices are a major concern for investors, and that's what will affect financial markets for now," Sheldon said.

Last week, oil prices climbed as high as $107 a barrel, but ended the week just above $101 a barrel.

In addition to watching crude prices, investors will also be tuning into the Federal Reserve's statement from its interest rate meeting on Tuesday for hints on how Chairman Ben Bernanke and monetary policymakers will handle surging oil prices.

The rest of the Fed's statement is expected to be a snooze, as the central bank is widely expected to leave its benchmark interest rate unchanged.

Monday: While no U.S. economic reports are due, investors may take a cue from market action across the world.

"The quake hit Tokyo half an hour before closing, so the market only had time to fall from around 10,370 to 10,254," noted Carl Weinberg, chief economist at High Frequency Economics, in a note to clients. "There are sure to be more losses on Monday when the market reopens."

The Tokyo Stock Exchange, in a statement, said Sunday that it plans regular trading on Monday.

Weinberg added that by Monday, investors should have a better idea of the infrastructure damages and about the challenges faced by individual companies.

Tuesday: The Empire Manufacturing survey is due before the start of trading. The regional reading on manufacturing is forecast to have jumped to 17 in March from 15.43 in February.

A report on import and export prices is also due in the morning.

After the opening bell, the National Association of Homebuilders is scheduled to release its housing market index for March. The index is forecast to edge up to 17 from 16 in February.

Wednesday: A report on February housing starts and building permits comes out in the morning. Economists expect that 570,000 homes broke ground in the month, down from 596,000 in January.

Building permits are expected to rise to 573,000 from 562,000, according to consensus estimates from Briefing.com.

The Producer Price Index, a measure of wholesale inflation, is due out from the Commerce Department at the same time. The index is expected to have edged up 0.6% in February after jumping 0.8% in January.

The so-called core PPI, which strips out volatile food and energy prices, is expected to have risen 0.2% after increasing 0.5% the previous month.

Thursday: The U.S. consumer price index, the government's main inflation gauge, is expected to show that prices rose 0.4% in February, matching the previous month's increase.

Economists expect consumer prices excluding food and energy to inch up 0.1%, slightly less than the 0.2% uptick in January.

The government's weekly report on initial claims for jobless benefits is expected to show a drop to 387,000 from 397,000 in the previous week.

An index on leading economic indicators for February is expected to increase 0.9%, after a 0.1% rise the month before.

Also out in the morning is the Philadelphia Fed index for February, a regional reading on manufacturing. The index is forecast to fell to 28, from 35.9 the previous month.

Friday: There are no market-moving economic or corporate events expected on Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |