The consumer stands strong

Yes, the economy is in rough shape. But consumers still are spending and that's helped lift profits at companies like Pepsi, Mickey D's and Hershey.

NEW YORK (CNNMoney.com) -- You gotta eat. That could be a big reason why several consumer companies have reported healthy quarterly results this week.

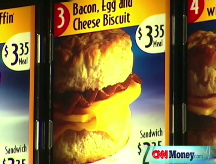

PepsiCo, McDonald's, Hershey and sandwich chain Panera Bread all reported better-than-expected profits. That could be a sign that, despite all the doom and gloom about the economy, the consumer is hanging in there.

Many consumer companies, particularly Pepsi (PEP, Fortune 500) and McDonald's (MCD, Fortune 500), are also benefiting from the weak dollar and stronger growth overseas.

But the success of Pepsi and Mickey D's can't be attributed entirely to international customers. McDonald's after all, was able to eke out a respectable 3.4% gain in U.S. same-store sales and a 6% gain in operating profit during the quarter.

Ditto for Pepsi. It reported sales growth of 4.5% in North America, led by an 8% increase in North American sales at its Frito-Lay snack division.

And Hershey (HSY, Fortune 500) generates only about 14% of its revenue outside the United States, so its 5% increase in sales had little to do with the weak dollar.

A company like Panera (PNRA) is generating all its sales from the United States. So its 33% increase in profits and 6.5% increase in company-owned same-store sales is all the more remarkable, especially since Panera said it has had to raise prices due to rising wheat costs.

While it is tempting to declare that the American consumer is finally tapped out, it simply doesn't appear to be true. Despite plunging consumer confidence, people aren't necessarily acting as skittish as they claim to be.

We will find out next week how the overall economy did in the second quarter when the government releases its first reading on gross domestic product (GDP) growth.

Economists are predicting a 1.8% increase in GDP (not a decline) from a year ago. And as was the case in the first quarter, economists expect consumer spending to help.

Of course, continued weakness in the housing market and soaring food and gas prices are taking their toll on consumers. Rising unemployment isn't helping either. I'm not trying to suggest that the economy is in good shape.

But once again, all this bad economic news has yet to manifest itself in the form of a sharp pullback in consumer spending.

To be sure, not all consumer companies reported good news today.

While consumers may still be spending on soda, sandwiches, candy bars and Big Macs, there is evidence that they are growing increasingly wary of buying bigger-ticket items.

Whirlpool (WHR, Fortune 500) reported this morning that U.S. shipments of major appliances (items like washers, dryers and refrigerators) fell 8% in the second quarter.

And as long as the housing market remains in a funk, it's hard to imagine how companies that make or sell pricey home products can thrive.

In addition, wholesale retailer Costco (COST, Fortune 500) warned that its fiscal fourth-quarter results would be "well below" Wall Street's consensus estimate of $1 per share.

The company blamed inflation, particularly rising gas prices, for the warning. Costco said profits would take a hit because the company is keeping prices low to "help drive sales and maintain the confidence" of its customers.

And that will be a trend worth keeping an eye on over the next few months. Costco and other discount retailers have been able to post decent sales growth during the past few months in part due to a focus on cost-conscious consumers as well as a boost from people spending some of their tax rebate checks.

So Costco may be sacrificing profits for top-line growth, which many not win the company fans on Wall Street. And if the economy weakens further over the next few months, more retailers and consumer product companies may be forced to hold the line on price increases even as commodity costs climb.

But it's still reassuring to see that the average consumer has yet to go into bunker mentality mode. And if oil prices continue to fall over the next few months as they have done over the past few days, that could only help the broader economy.

Issue #1 - America's Money: All this week at noon ET, CNN explains how the weakening economy affects you. Full coverage.

Have you had to raise cash this year for an unexpected expense? We're looking for people who got the cash by doing one of the following: Took out a home-equity loan, borrowed money from family or friends, borrowed against a retirement account such as a 401(k), sold a life-insurance policy. Is that you?

Drop us a line at realpeople@moneymail.com, and you may be spotlighted in Money magazine and on CNNMoney.com. Please tell us why you needed the cash, how much cash you raised by doing it, when you did it and if you were happy with your decision. Also please include your name, age, city, contact information and a recent family photo. ![]()