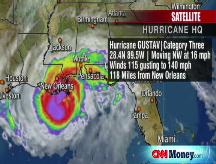

Gustav hits U.S. economy

Storm is weaker than Katrina three years ago. But it hits an economy that is at greater risk.

NEW YORK (CNNMoney.com) -- Hurricane Gustav hit the U.S. Gulf Coast on Monday with far less force than Hurricane Katrina did three years ago, but its economic bite could be worse as it hits a national economy that is far weaker than the one battered by Katrina in 2005.

Economists agree that in the long run, a major hurricane or other natural disaster can actually help lift economic activity because of insurance payments and federal assistance.

In the short-term, the destruction and the disruptions can be a hit to the economy.

EQECAT, a firm that estimates losses for the insurance industry, said Gustav could end up causing between $6 billion and $10 billion in insured losses. That amount is a fraction of the $41 billion in insured losses caused by Katrina three years ago, but still enough to make it among the ten most costly storms in U.S. history.

But even with lower loss estimates, the weakened state of the U.S. economy - suffering a housing downturn, credit crunch and job sector woes - is one of the biggest concerns of economists trying to assess the impact that Gustav will have.

"Even if it causes $10 billion in damage, that is not a huge deal for the overall economy. But it's coming on top of everything else going wrong," said David Wyss, chief economist for Standard & Poor's. "It makes it more likely the recession scenario for the end of the year."

Rich Yamarone, director of economic research at Argus Research, said one of the reasons limiting Katrina's economic impact was the strength of the economy at that time. "That showed how incredibly resilient and flexible the economy was in 2005," he said.

Yamarone said he's concerned that Gustav comes at a worse time.

"It's another blow to an economy that can't afford to take these punches," he said. "It could push us a lot closer to a recession."

One of the greatest shocks for the overall U.S. economy could come from another spike in energy prices.

Futures prices for crude oil, gasoline and natural gas fell Monday as traders bet that damage would not be as bad as expected. But some experts said it is too soon to predict there won't be a rise in those key energy prices. They point out that energy prices didn't start to climb until days after Katrina hit in 2005.

"We probably won't know until Thursday the full assessment of what the damage will be," said Kenneth Medlock, energy fellow at Rice University.

Given the course of the storm, Medlock is more worried about natural gas prices rather than oil and gasoline. About 10% of the natural gas that Americans consume is produced off the U.S. Gulf Coast. By contrast, only 5% of the crude oil use in the United States is produced in the Gulf region.

"It crossed right through that (natural gas) territory," Medlock said. "If there was any damage to that particular infrastructure, it could affect natural gas production for some time."

Natural gas is the leading fuel used for winter heating, and accounts for about 20% of the nation's electric generation.

Medlock said damage to the natural gas supplies could cause natural gas prices to spike 10 to 20%. He said those hoping for an economic recovery were counting on gasoline and natural gas prices not turning higher after their recent retreat.

"If there's any sustained damage, all of that gets turned on its head," he said. "That would certainly hamper any sort of recovery."

But some economists believe that without any damage to the energy sector, the U.S. economy should be able to ride out any damage from Gustav.

"It's a big personal disaster story, a big regional disaster story. But it shouldn't be big for the economy unless it hits the energy sector hard," said Bob Brusca of FAO Economics.

Another concern for many economists is that exports have been they key area of strength in a U.S. economy hit by a housing downturn, a credit crunch and declining corporate profits. And many of those exports, especially agricultural exports, could be severely disrupted by the storm.

Wyss points out the main gateway for the nation's exports are the five deepwater ports on the Mississippi River in and near New Orleans, and that it can take time for those facilities to resume normal operation after a major storm. While the Port of New Orleans resumed some operations less than two weeks after Katrina, it was still operating at only at 80% of pre-storm capacity six months later.

Wyss also said he's worried that insurers and re-insurance companies could be forced to sell assets to pay out claims - and put additional stress on the already-battered financial sector.

"It is not going to kill them compared to the $500 billion writeoffs they've taken on subprime, but it is more losses," he said. ![]()