Investing for your kids' and your future

The perfect plan: After suffering a layoff and a stock slump, the Elliotts are stretching to save for college and retirement.

|

| Patrick and Susanne Elliott, with daughters Shannon and Madelyn |

NEW YORK (Money Magazine) -- Talk about investing in uncertain times. At the beginning of last year, Susanne Elliott was downsized from her management position at a record label. Then, just two months after she found a similar job at a competing firm in August, the bear market struck.

Susanne, 44, and her husband Patrick, 46, who works at a food distributor, have so far lost around 10% of their retirement savings in the downturn. "I try not to look anymore because it's just brutal," Susanne says.

But the Washington Township, N.J., couple can't ignore their account statements completely because they're investing for two expensive goals at the same time.

Though the Elliotts got an early jump on savings, they started a family late. Their daughters Shannon, 6, and Madelyn, 15 months, will start sending home college tuition bills around the same time Mom and Dad hit 60 and their prime retirement savings years.

The couple have always been a bit concerned about that - but their recent stock market setback has made them downright nervous. As Susanne puts it: "The expenses of having children won't be gone as we get ready to retire."

The Elliotts have decided to make saving for retirement Priority No. 1, even if it means not fully funding the girls' college education. That's the right decision, says James Christie, a financial planner in Basking Ridge, N.J.

After all, the kids can get loans for college. Yet no one will lend the Elliotts money for retirement. Even with their recent losses, the Elliotts are on track to accumulate some $1.6 million in today's dollars when they retire at 67.

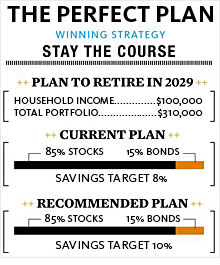

To ensure that they get there, Susanne must continue to earmark 10% of her salary for her 401(k). Meanwhile, Patrick, who just became eligible to participate in a 401(k), should contribute to at least the full company match. That would boost the couple's overall savings rate from around 8% to 10%, which Christie recommends.

As for investments, most of their retirement money is in a target-date fund: T. Rowe Price Retirement 2030 (TRRCX). Christie recommends sticking with it because the fund's current mix of 85% stocks and 15% bonds is appropriate for them and because the fund will automatically adjust that over time - great for a busy couple.

As for college, if the Elliotts adjust their tax withholding (they got an $8,200 refund check for 2007), they'll keep an extra $500 or so a month. Christie suggests adding some of that to the $200 a month they now put in their kids' 529 college plans. They could then cover at least half the cost of in-state tuition for both daughters.

Be featured in Money Magazine: Do you (and your spouse) make more than $170,000 annually and worry about tax-efficient retirement planning? If so, send your name, age, occupation, income and questions, along with a recent photo, to makeover@moneymail.com. We will be providing advice to a family in this situation in an upcoming article - and it could be you! ![]()