Bailout: What's next

Paulson in high-stakes negotiation over $700 billion financial bailout.

NEW YORK (CNNMoney.com) -- Now the clock is really ticking.

One week after Treasury Secretary Henry Paulson first announced that he was working on a giant bailout of the financial system, Congress and President Bush are racing to reach a final agreement. But the situation is still fluid.

After endless rounds of meetings this week, lawmakers are hoping to have a deal agreeable to both parties hammered out before Bush meets with presidential candidates Barack Obama and John McCain, as well as congressional leaders, Thursday afternoon.

"We hope to reach a bipartisan consensus in time for this afternoon's meeting at the White House, so Sen. McCain and President Bush can finally get to work on the job they've neglected thus far: delivering Republican votes," said Sen. Charles Schumer, D-N.Y.

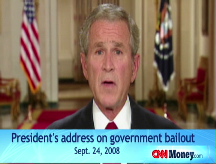

Lawmakers reached a general agreement Wednesday, after hours of testimony from and closed-door negotiations with Paulson and Federal Reserve Chairman Ben Bernanke. The day ended with the president outlining the Bush addressed the nation facing the economy in a prime-time presentation.

Acknowledging that many Americans are furious at the idea that their tax money would go to bail out Wall Street, Paulson said in hearings Wednesday that he was open to capping executive compensation at firms that participate in the bailout plan. He also indicated the final rescue plan would include more help for struggling homeowners.

But he said he did not support allowing bankruptcy judges to modify mortgage terms, which Democrats and many community advocates are pushing as the best way to help stem the tide of foreclosures.

Meanwhile, the hard work of negotiating final legislation continues, with officials saying time is of the essence. Banks are still clamping down on their lending, and investors hang on every word out of Washington.

"It should be enacted as soon as possible," Bush said. "Given the situation we are facing, not passing a bill now would cost these Americans much more later."

Here's where the debate stands:

The plan: The Bush administration's plan would allow the Treasury to buy $700 billion in troubled assets - mainly mortgage-backed loans - from American financial institutions and companies doing business in the United States. The aim is for the government to buy the assets at a discount, hold onto them and then sell them for a profit.

Private money managers would oversee the assets while they are in the government's possession.

What remains to be seen is how the Treasury Department will structure the purchases and how much they'll pay for the assets.

One purchasing method that Treasury has suggested is a reverse auction to set the discount at which the assets would be picked up. A question that remains is whether the benchmark would be the assets' current market price or their value if they were held to maturity.

The primary target is mortgage-backed securities that have seen their value plunge due to rising foreclosures and a prolonged slide in home prices, but debt tied to auto loans and credit cards may also be included.

The Treasury plan allows the government to buy the assets for two years after the plan is enacted.

The Treasury thinks that by taking problem assets away from banks, financial institutions will be able to shore up their balance sheets, allowing them to lend to consumers and other banks again.

Add-ons: Over the past days, discussion of the bailout has been dominated by various ideas for what to add to it.

Lawmakers want to add provisions that provide oversight; curb executive pay at companies that sell assets to the Treasury; let the government have the option of taking an equity stake in companies that participate; and require the government to encourage foreclosure prevention for the troubled loans it purchases.

What's in Congress' final version remains to be seen. Negotiations were continuing on Thursday morning.

Help for housing markets: Many experts are skeptical of the plan, especially in its indirect ability to help homeowners.

The Senate Democrats' proposal would require the government to include in the bailout proposal a separate systematic way to keep people in their homes.

Both of the Democratic proposals pushed for foreclosure prevention through loan modifications and use of the HOPE for Homeowners Program on the mortgages the government will buy in the bailout.

Dodd also called for a change to federal law so that bankruptcy judges can modify mortgages in default. Under current law, judges may only modify loans on second homes.

The cost: The Treasury's proposal calls for government authorization to purchase as much as $700 billion of bad loans.

No one yet knows how much taxpayers will have to pay in the end, because the government plans on holding onto the assets until the markets improve. The Treasury then plans to sell those loans with the hope that the government might even make a profit.

In testimony before the House Budget Committee on Wednesday, Congressional Budget Office Director Peter Orszag said the net cost to taxpayers will be "substantially less" than the $700 billion headline number, though he said an estimate was impossible.

"It seems implausible that the U.S. would lose every cent on the dollar for the purchases it made," Orszag said.

Orszag added that the Federal Reserve may raise interest rates if the market suspects that the Treasury overpaid for assets in the bailout.

As part of the program, the Bush administration wants Congress to increase the nation's debt ceiling. Currently, it's set to rise to $10.6 trillion for fiscal year 2009, which starts Oct. 1. The proposal calls for the limit to be increased to $11.3 trillion.

Ranking member of the Senate Banking Committee Richard Shelby, R-Ala., said taxpayers will have to help foot some of the bill.

Market reaction: The bailout was first announced last Thursday, and investors cheered the plan Friday, sending stocks soaring. But as it became clear that the plan would face many hurdles before enactment, stocks have sold off.

Other markets have been extremely volatile over concerns with the amount of debt the government would have to issue for the bailout. The dollar has been under pressure and investors have fled to the safety of Treasurys, sending their prices soaring and yields plummeting.

Banks, meanwhile, are continuing to hoard their cash, curbing lending to businesses, consumers and even to each other.

-- CNNMoney.com senior writers Jeanne Sahadi and Tami Luhby contributed to this report. ![]()