Lots of banks interested in bailout - Paulson

Treasury Department lays out process for banks to apply for funding.

NEW YORK (CNNMoney.com) -- Banks of all sizes are interested in a piece of the federal government's $250 billion fund to recapitalize financial institutions, Treasury Secretary Henry Paulson said Monday.

"We have received indications of interest from a broad group of banks of all sizes," he said at a briefing in Washington.

The capital infusion is among the government's latest attempts to strengthen the teetering United States financial system. The funds come from the $700 billion bailout package passed by Congress in early October and follows similar moves by European governments.

Many America banks, however, are lukewarm to the idea of having the government take an equity stake in the program, which was announced a week ago.

Banks must apply for funds by Nov. 14, Paulson said. They must consult with their primary federal regulator before applying.

Banks could start receiving money soon after they apply, regulators said. The government won't wait until the deadline to release the funds.

Under guidelines released Monday, an eligible institution will be able to sell the government an equity stake of up to 3% of its risk-weighted assets. The aid will take the form of preferred stock.

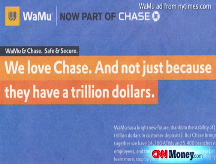

Nine of the nation's largest banks have already agreed to participate in the program and will receive half the funds. They are: Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500), Morgan Stanley (MS, Fortune 500), Goldman Sachs (GS, Fortune 500), Merrill Lynch (MER, Fortune 500), State Street (STT, Fortune 500) and Bank of New York Mellon (BK, Fortune 500).

Any bank, savings association, bank holding company or savings and loan holding company established and operating in the United States is eligible. Institutions controlled by foreign companies are not.

However, regulators indicated that banks in serious financial trouble may not qualify for the capital injections. When pressed, they declined to specify why a bank would be deemed too unhealthy to participate. Among the criteria regulators are examining are an institution's health, lending ability, possibility of outside capital raising and merger opportunities.

Being involved in a merger could make an otherwise unhealthy bank eligible for an infusion, they said.

The government investments will be considered Tier 1 capital, which supports a bank's lending operation.

There is enough money to go around, Paulson said.

"Sufficient capital has been allocated so that all qualifying banks can participate," Paulson said. "Let me be clear that this program is not being implemented on a first-come, first-served basis."

Banks, however, may not rush to sign up for the infusion, said Sean Ryan, analyst with Sterne Agee. Executives may be concerned about the stigma and about letting the government into their affairs, though the government stake does not have voting power.

Still, there's no question whether banks should participate since the funding is so cheap, he said. The government program requires the institutions pay dividends of 5% for the first five years and 9% after. Other banks raising capital are paying upwards of 10% on preferred shares in their offerings.

"It should be a fairly easy decision," Ryan said. The terms "are much more lenient than banks will find elsewhere anytime soon."

Banks are still waiting for more details on the use of the funding, the program's cost and the eligibility criteria, said Wayne Abernathy, executive vice president for financial institutions policy at the American Bankers Association.

Though many were worried about a stigma, Paulson's characterization of the capital plan as a way to revive the economy may put some bankers at ease, he said.

"If this is seen in the public mind as a bailout for weak banks, then who wants to step up for that kind of moniker?" Abernathy said. "But if this is all about banks being partners with the public sector to be engines of economic growth, then I think bankers can warm up to that because that's how banks see themselves."

About half of Independent Community Bankers of America members surveyed said they'd be interested in participating or learning more about the plan, said Paul Merski, chief economist for the group representing smaller banks.

Government officials are working to modify the plan to allow all banks to participate, the bank lobbyists said. For instance, the roughly 2,500 S-corporation banks in the U.S. can't offer preferred stock so they are locked out under the original terms.

Those that do sign up can't keep the money in-house, Paulson said. One of the main problems in the weakening economy is that banks are afraid to lend.

"Our purpose is to increase confidence in our banks, so that they will deploy, not hoard, their capital," Paulson said. "And we expect them to do so, as increased confidence will lead to increased lending. This increased lending will benefit the U.S. economy and the American people."

Participating banks aren't likely to hold onto the funds since they are paying a 5% dividend on it, Merski said. They'll need to put it to use to cover that cost.

"Banks will have every intention to use this money to lend because that's how they make profits," Merski said. "Banks aren't going to take it and let it sit on their books."

-- CNN Senior Producer Scott Spoerry contributed to this report. ![]()