Fed cuts rates and gives grim view

Fed lowers benchmark rate by a half-point as it continues to fight the ongoing crisis in the credit markets; warns that economic recovery will take time.

NEW YORK (CNNMoney.com) -- The Federal Reserve cut a key short-term interest rate by a half-percentage point Wednesday and issued a gloomy outlook for the economy due to continued worries about the ongoing crisis in the financial and credit markets.

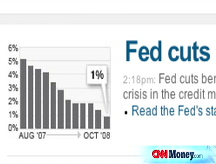

The rate cut put the central bank's federal funds rate at 1%. That matched the lowest level for this overnight bank lending rate ever -- the last time it was at 1% was from June 2003 to June 2004.

Investors had been expecting a half-point cut and some were betting that the Fed would even cut rates by three-quarters of a point to 0.75%.

Major U.S. stock indexes, which had been higher ahead of the Fed's decision, fell after the announcement and finished mostly lower following a wild afternoon of trading.

The fed funds rate is used to set rates for a wide variety of consumer loans, including home equity lines and credit cards, as well as for many business loans. The lower the rate, the more the Fed hopes to spur economic activity.

The Fed said in a statement that it was concerned about the drop-off in consumer and business spending due disruptions in the credit markets and warned that the economic slowdown is likely to get worse.

"The intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit," the central bank said in its statement.

Economists generally agreed this is the Fed's most grim assessment of the economy since the Fed started issuing statements with interest rate decisions in 1995.

"They go through a litany of all these problems," said Gus Faucher, director of macroeconomics, Moody's Economy.com. He added that he thinks this statement is the Fed's way of indicating that the U.S. is already in a recession and that the economy will remain weak well into 2009.

This is the ninth time that the central bank has lowered rates since September 2007 in an effort to deal with the problems in the U.S. economy and credit markets. The decision to lower rates was unanimous.

The Fed also lowered its discount rate by a half-percentage point to 1.25%. That is the rate at which it lends directly to banks and Wall Street firms.

In its statement, the Fed also appeared to concede that the rate cuts and a number of other actions it has taken to pump hundreds of billions of dollars into the credit markets would not lead to an immediate return of economic growth.

The Fed projected improved credit markets and a return of moderate growth "over time." And it warned that "downside risks to growth remain."

The Fed's grim view of the economy is expected to be reinforced Thursday morning when the Commerce Department issues its first reading on gross domestic product, the broadest measure of the nation's economic activity, for the third quarter.

Economists surveyed by Briefing.com forecast that GDP declined by 0.5% annually after jumping 2.8% in the second quarter. If the GDP number is negative, it would be only the fifth quarter in more than 17 years that has happened.

Faucher said he believes that the risk of further weakening in the economy, coupled by the unanimous vote, is a signal that the Fed is not done lowering rates yet. He's predicting another half-point cut, to 0.5%, at its next scheduled meeting on December 16.

Kurt Karl, chief economist at Swiss Re, is also looking for another half-point cut by the end of the year.

"In aggressively cutting rates, the Fed is signaling its willingness to do what it takes to stabilize financial markets," he said.

But other economists expressed fears that the Fed has already left itself with limited ability to respond to future problems by taking rates this low.

"Now they're running low on ammunition," said Rich Yamarone, director of economic research at Argus Research. "They look like Barney Fife with one bullet left. That's not too encouraging."

Other economists agreed, saying they believe Fed policymakers would prefer to not cut rates below 1%.

"I don't think there's anything to prohibit them from going under 1%, but there also is probably not a great deal of urgency on their part to bring rates lower," said Keith Hembre, chief economist First American Funds.

One economist questioned whether rate cuts really can make much difference since the current credit crunch is limiting the availability of funding. The problem isn't that loans are expensive. Banks are simply unwilling to lend.

"The latest Fed move is not going to hasten the economic recovery by a single day or accelerate the cleansing of bank balance sheets," said Bernard Baumohl, executive director of The Economic Outlook Group. "What is needed more than anything else at this stage is simply patience."

The Fed's previous cut was an emergency half-point reduction on Oct. 8. Six other central banks around the globe also lowered rates that day in a coordinated move.

The European Central Bank and the Bank of England are scheduled to meet next on Nov. 6. Those central banks have significantly higher benchmark rates, with the ECB now at 3.75% and the Bank of England at 4.5%.

While rate cuts are traditionally the key tool the Fed uses to stimulate the U.S. economy, it has had to take other steps to address the current credit crisis.

The Fed has loaned hundreds of billions of dollars to banks through a new lending facility and is starting to loan money directly to major businesses by purchasing commercial paper, which is what some banks and businesses use as their primary method to fund day to day operations. ![]()