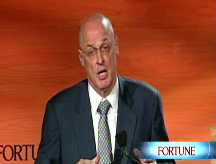

Paulson: Feds to expand rescue

Treasury Secretary Henry Paulson said more needs to be done. The agency is 'actively' developing additional programs to boost lending.

NEW YORK (CNNMoney.com) -- The federal government is reviewing applications from hundreds of banks seeking rescue funding and is "actively" developing new programs to right the nation's unsettled financial system, Treasury Secretary Henry Paulson said Monday.

"Today we continue to work through a severe financial crisis," Paulson said, speaking in Washington, D.C., at the Fortune 500 Forum, a conference of executives and policymakers. "While we are making progress, the journey ahead will continue to be a difficult one."

The Treasury Department so far has injected $150 billion in capital into the financial system by buying preferred shares in 52 institutions. "Hundreds more" applications are under review, Paulson said.

Paulson, addressing one of the key criticisms of the government's massive $700 billion bailout effort, said that officials are hopeful that banks will begin lending more to consumers and businesses.

"We expect banks to increase their lending as a result of these efforts and it is important that they do so," Paulson said. "This lending won't materialize as fast as any of us would like, but it will happen much, much faster as confidence is restored."

After announcing a massive effort last week to jumpstart consumer lending, Paulson Monday said the program may be expanded to include other assets, such as securities backed by commercial mortgages and by residential mortgages not guaranteed by Fannie or Freddie.

"We are actively engaged in developing additional programs to strengthen our financial system so that lending flows into our economy," Paulson said.

Supporting the financial system is also the best way to pull America out of a recession, he said. The National Bureau of Economic Research said Monday that the nation has been in a recession since December 2007, one of the longest downturns it has faced since the Great Depression.

"This is not going to be big news," Paulson said. "One of the most effective things we can do is strengthen that financial system and get credit flowing again."

Paulson's comments come a week after the government announced another round of dramatic measures to prop up the financial system.

Last Tuesday, the Treasury Department and the Federal Reserve unveiled a joint program to spur purchases of consumer loans bundled into securities. The effort calls for the Federal Reserve of New York to lend $200 billion to investors in securities backed by consumer debt, such as student loans, car loans and credit cards. The Treasury Department will allocate $20 billion to cover any losses that the New York Fed might suffer if that debt defaults.

In addition, the Federal Reserve, announced it will purchase up to $500 billion in mortgage backed securities that have been backed by Fannie Mae (FNM, Fortune 500), Freddie Mac (FRE, Fortune 500) and Ginnie Mae, the three government-sponsored mortgage finance firms set up to promote home ownership. It will also buy another $100 billion in direct debt issued by those firms.

A day earlier, the Treasury and the Federal Deposit Insurance Corp. said it would rescue faltering Citigroup (C, Fortune 500). It agreed to guarantee some of the firm's losses in its $300 billion portfolio of troubled assets. Also, Treasury will make a fresh $20 billion investment in the bank on top of the $25 billion it already injected into the Wall Street bank.

Paulson has used nearly half of the $700 billion in funds Congress allocated to stabilize the financial markets. He has said he would not ask lawmakers for the remaining $350 billion, leaving it for the administration of incoming president Barack Obama to use. ![]()