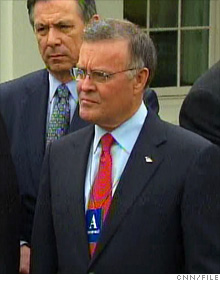

Ken Lewis out as BofA chairman

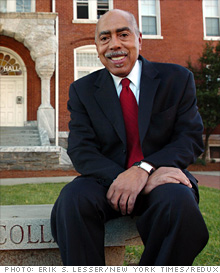

Activist shareholders win major victory as bank names board member Walter Massey as new chairman; Lewis to remain as CEO.

|

| Bank of America CEO Ken Lewis was stripped of his title as chairman following the company's annual shareholder meeting Wednesday. |

|

| Walter Massey, a former president of Morehouse College and a long-time Bank of America director, is replacing Lewis as the bank's chairman. |

|

| Bank of America shares have lost three quarters of their value since the Merrill Lynch deal was announced in September. |

NEW YORK (CNNMoney.com) -- Bank of America chief executive officer Ken Lewis was ousted from his role as chairman of the bank after shareholders approved a proposal to require that the company have an independent chairman.

The bank announced Thursday that Lewis would remain president and CEO of the company. Long-time Bank of America director Dr. Walter E. Massey, a former president of Morehouse College, will replace Lewis as chairman.

Lewis, Massey and 16 other company directors were reelected to the board by comfortable margins at the company's annual shareholder meeting, the bank said.

But in a separate vote, shareholders narrowly approved a resolution to separate the chairman and CEO roles. This represents a significant victory for shareholder activists who ran an aggressive campaign aimed at stripping Lewis of his chairman title.

Wall Street was keeping a close eye on Wednesday's outcome after the results of the election were delayed by several hours due to a heavy volume of votes cast.

Votes at annual shareholder meetings usually do not reach this level of controversy, as large institutional investors like mutual funds tend to vote with management.

A number of highly criticized incumbent directors at Citigroup (C, Fortune 500), for example, easily won re-election last week despite a major shareholder campaign to push them out.

But the support for Lewis appeared to erode in recent days as major institutional investors like CalPERS, California's pension fund for workers in the public sector threw their support behind the shareholder measure earlier this week.

While there were many signs of shareholder support for Lewis at Wednesday's meeting, several investors were not shy about making known their feelings about how the nation's biggest bank by deposits has been run over the past year.

Investors from as far away as San Francisco and Boston groused about the extensive government support offered to Bank of America (BAC, Fortune 500), the bank's toxic assets and the company's bold acquisitions over the past year - mortgage lender Countrywide Financial and Merrill Lynch.

Several of those who spoke at Wednesday's meeting in Bank of America's hometown of Charlotte, N.C., focused on Merrill, a last-minute purchase Bank of America announced just as Lehman Brothers was on the verge of collapse.

"You knew what was going on with Merrill. You kept it from us and you are still keeping it from us," said one attendee at the meeting in Bank of America's hometown of Charlotte, N.C.

The company's decision to buy Merrill has become a major problem for Lewis, a 40-year veteran of the firm and its predecessors who has been at the helm since 2001.

In mid-January, the company revealed that it needed $20 billion in government funds, along with guarantees on $118 billion in assets, to help the company absorb its purchase.

That came on top of $25 billion Bank of America had already received -- which included $10 billion for Merrill Lynch -- from the government as part of the Troubled Asset Relief Program, or TARP.

Lewis has been heavily criticized by shareholders for not telling investors more about how bad things were at Merrill.

The two activist shareholder groups which ran the campaign aimed at stripping Lewis of his title as chairman -- CtW Investment Group, an investment advisor to pension funds and Finger Interests, which holds 1.1 million in company shares -- argued that he deserved blame for allowing the deal to go through.

But there have been revelations in recent days that Lewis may have had little choice in the matter.

Documents released last week by New York Attorney General Andrew Cuomo revealed that Lewis approached former Treasury Secretary Henry Paulson and current Federal Reserve Chairman Ben Bernanke about nixing the Merrill deal in late December after discovering the scope of the losses on that firm's balance sheet.

At the time of his testimony, Lewis said Paulson threatened a change in management should Bank of America back out of the deal.

Lewis, however, maintained Wednesday that the company's decision to go ahead with the Merrill purchase was not based on that threat but was done in the best interest of shareholders. He added that backing out could have delivered a severe blow to the nation's financial system, which many argue was teetering on the brink at the time.

"We took very seriously the likelihood of a systemic meltdown," Lewis said in a speech to investors.

In his remarks, Lewis took pains to acknowledge many shareholder criticisms, but he defended the purchase of Merrill as a way to help the company reach its of becoming a more diverse financial services company.

Shareholder frustration over Lewis has only been further fueled by the sharp decline in BofA's stock price.

Even though shares of BofA have enjoyed a rebound in recent weeks along with other banks, shares are still down more than 40% this year and 75% since the Merrill deal was announced in mid-September. ![]()